WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

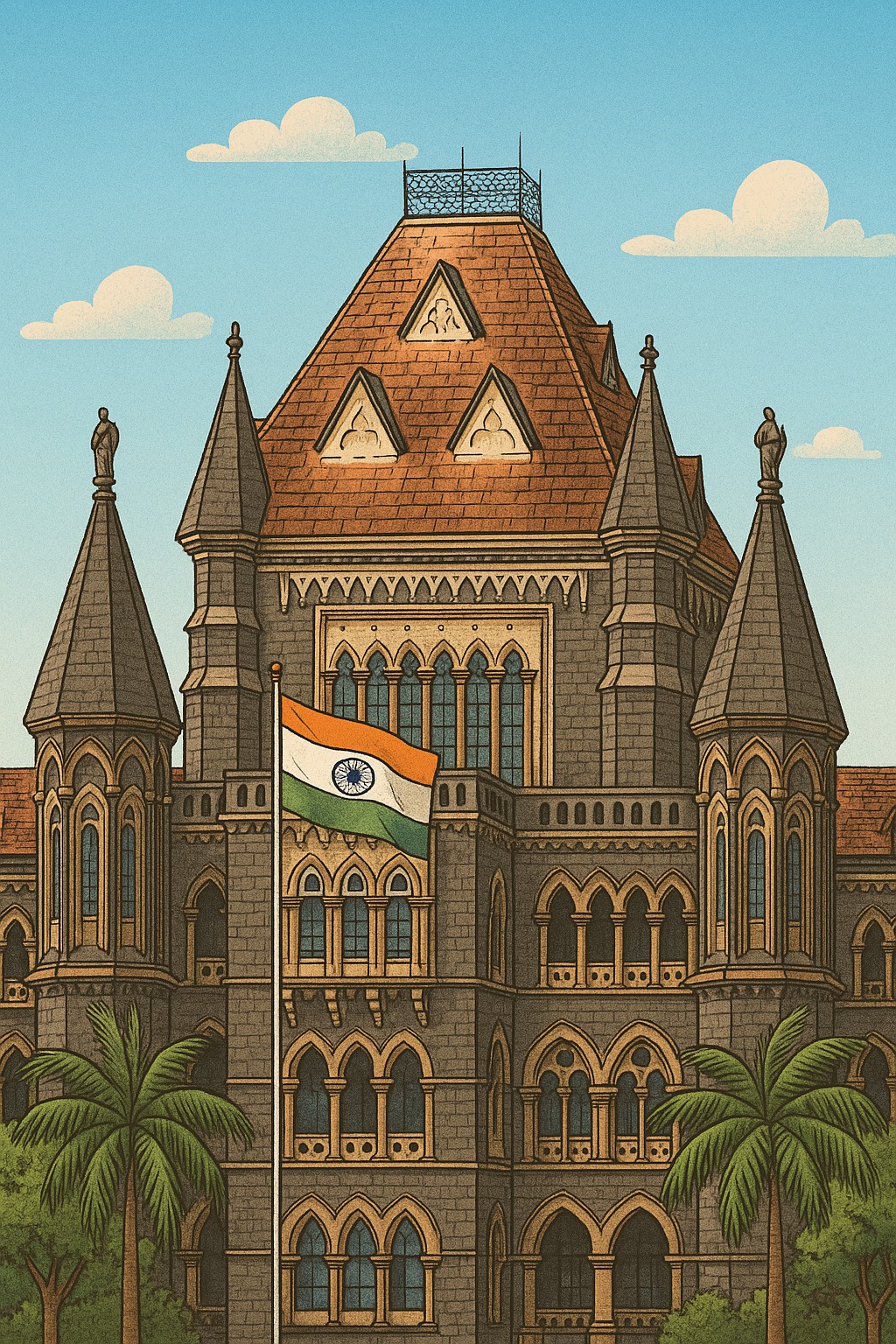

The Bombay High Court has ruled that the rate of Dividend Distribution Tax (DDT) applicable on dividends paid to Non-Resident Shareholders (NRIs, OCIs and Foreign Investors) cannot exceed the tax rate specified under the applicable Double Taxation Avoidance Agreement (DTAA).

This important tax ruling overturns the earlier ITAT Special Bench judgment, which had held that non-residents could not claim DTAA benefits on dividend taxation when DDT was applicable.

This landmark decision provides significant relief for NRIs and foreign investors and opens the possibility for Indian companies to claim refund of excess Dividend Distribution Tax (DDT) paid for dividends distributed up to 31 March 2020 (before DDT was abolished).

The Court held that:

DDT payable on dividends distributed to non-resident shareholders cannot exceed the DTAA rate applicable to dividend income

Under many DTAAs, the tax rate on dividends is much lower than India’s former DDT rate of 20.56%, for example:

| Country (DTAA) | DTAA Dividend Tax Rate | Excess Paid Under DDT |

| Hong Kong | 5% | ~15.56% higher |

| UAE | 10% | ~10.56% higher |

| USA / UK | 15% | ~5.56% higher |

| Singapore | 10% / 15% | 10.56% / 5.56% |

| Netherlands | 10% | 10.56% higher |

This judgment directly contradicts the ITAT Special Bench, which previously ruled that DTAA benefit could not override DDT, reinforcing the relevance of Dtaa Consultancy.

For Dividend Paid Prior to 31 March 2020

The ruling now allows:

For Dividend Paid After 1 April 2020

This ruling is particularly relevant for:

If excess DDT was paid, a refund claim may be possible, subject to limitations.

Can companies claim refund of DDT paid in earlier years?

Yes — companies may claim refund for dividends paid up to 31 March 2020 where DTAA rate < 20.56% DDT.

Are NRIs eligible for lower tax on dividend income under DTAA?

Yes — NRIs can claim reduced tax rate as per the DTAA of their country of residence.

Does the ruling affect dividend repatriation to foreign shareholders?

Yes — lowers tax leakage and increases net repatriable dividend.

Does this ruling help in cross-border tax planning and international tax structuring?

Absolutely — supports treaty protection and improves tax efficiency for foreign investors.

As specialists in NRI Taxation, DTAA Advisory, International Tax & Cross-border Transactions, we assist companies and NRIs with:

The Bombay High Court ruling on Dividend Distribution Tax (DDT) and DTAA applicability is a huge relief for NRIs and foreign investors, reinforces treaty protection, and creates a major opportunity for refund of excess DDT paid. This decision strengthens India’s global investment landscape and encourages fair cross-border taxation.