WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

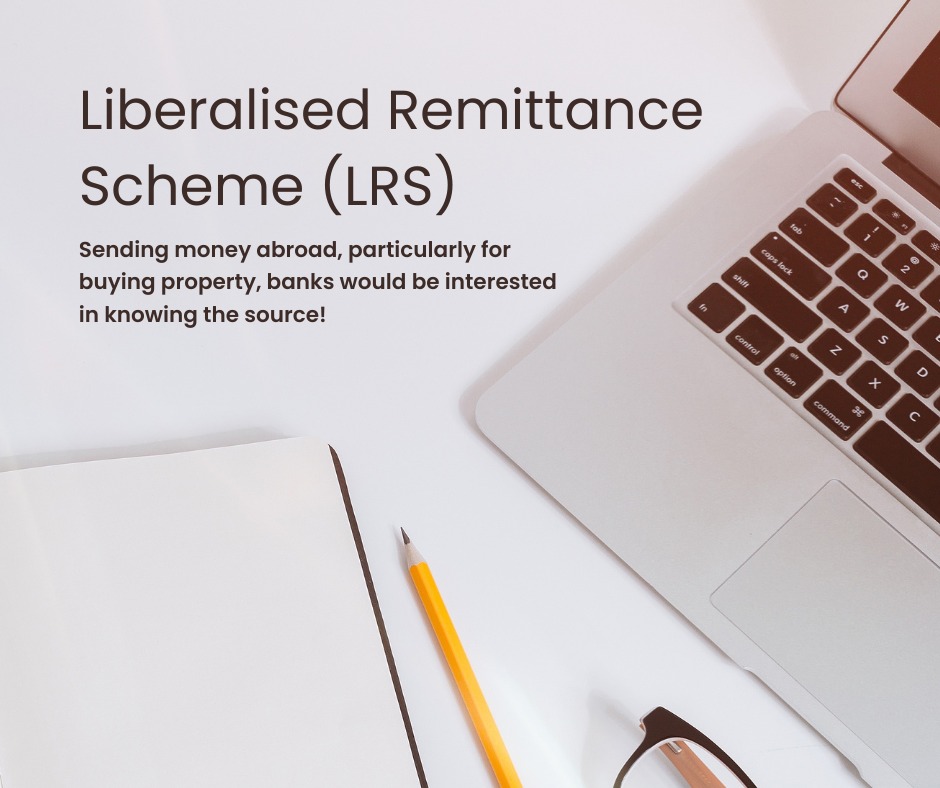

As the trend of Indians investing in properties abroad gains momentum, banks have begun to inquire about the origins of funds being moved overseas. This scrutiny comes amid the growing popularity of the Liberalised Remittance Scheme (LRS), which allows residents to transfer up to $250,000 annually for various purposes, including property acquisitions.

While the LRS has been in place since 2004, recent developments have seen banks exercising greater caution in approving LRS remittances. Some institutions are delving into individuals' past income statements to ascertain the source of funds, while others are specifically questioning whether transferred funds are gifts from relatives.

The surge in remittances under the LRS, from $12.68 billion in 2020-21 to $27.14 billion in 2022-23, reflects the growing interest in overseas investments among Indians. However, this increase has prompted banks to implement stricter scrutiny measures, often holding back remittances based on undisclosed internal directives.

Two private banks have notably intensified their scrutiny of fund sources, citing concerns that the LRS may be misused for unintended purposes. While the original intent of the scheme was to facilitate legitimate capital and current account transactions, banks now feel compelled to verify the source of funds to prevent misuse or potential money laundering.

Although the LRS guidelines do not mandate inquiries into fund sources, banks are exercising their discretion to ensure compliance with the scheme's limits and prevent circumvention. Instances where individuals exceed their LRS limits or utilize borrowed or company-derived funds for remittances are now under increased scrutiny.

Notably, the remittance of gifts, often used to accumulate funds for overseas property investments or migration to countries offering citizenship by investment programs, has come under particular scrutiny. While not mandated by LRS norms, banks view such inquiries as necessary checks to uphold regulatory compliance.

Ultimately, while the increased scrutiny may cause temporary inconvenience for remitters, it reflects the banking sector's commitment to preventing misuse of the LRS and ensuring compliance with regulatory requirements. As the landscape evolves, individuals are advised to maintain transparency regarding the sources of their remitted funds to facilitate smoother transactions and avoid potential delays.