WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

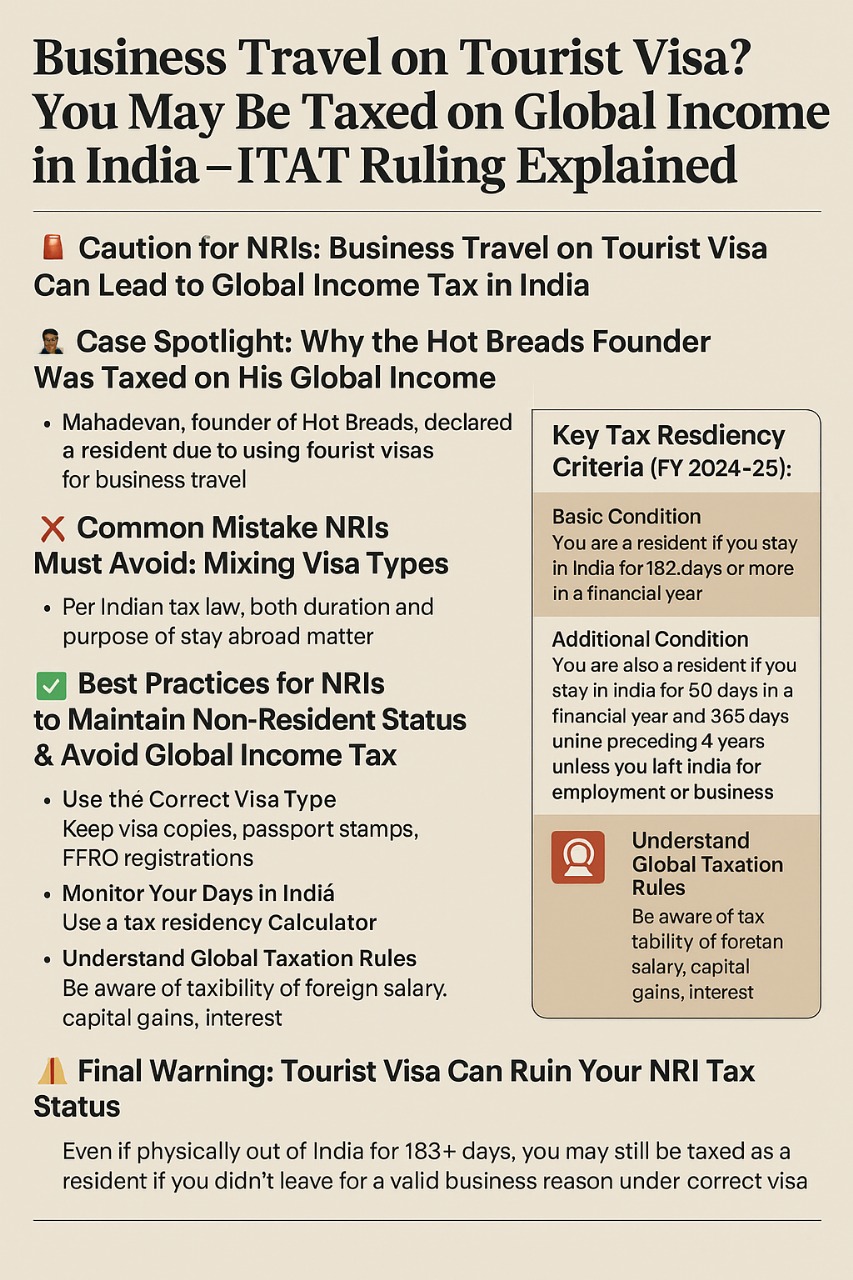

If you're a Non-Resident Indian (NRI), Indian citizen, or businessperson who travels abroad frequently, beware: using a tourist visa for business purposes can result in you being taxed in India on your global income.

In a critical 2025 ruling, the Income Tax Appellate Tribunal (ITAT) held that even if a person spends over 182 days outside India, misuse of visa type can make them a resident under Indian tax laws, triggering full tax liability on worldwide income.

The case involved M. Mahadevan, founder of the popular bakery chain Hot Breads, who frequently travelled abroad but did so using tourist visas, even when conducting business.

Though he was physically outside India for more than 182 days in relevant years (2013–14, 2014–15, and 2019–20), the IT Department declared him a resident and taxed his entire global income. Why? Because the purpose of travel did not match the visa used.

This case sets a strong precedent: travel documentation and visa category directly affect NRI tax status in India.

Many Indians and NRIs assume that if they spend over 182 days outside India, they automatically become non-residents. However, Indian tax law under Section 6 of the Income Tax Act states that both duration and purpose of stay abroad matter.

Using a tourist visa for business travel is a red flag for tax authorities.

| Rule | Explanation |

| Basic Condition | You are a resident if you stay in India for 182 days or more in a financial year. |

| Additional Condition | You are also a resident if you stay in India for 60 days in a financial year and 365 days in the preceding 4 years, unless you left India for employment or business. |

If you leave India under a tourist visa, the IT Department can argue that you didn't leave for employment/business. That strips you of non-resident status—even if you stayed abroad for over 182 days.

You must not use tourist visas if your travel abroad is related to:

Even if you're engaging in legitimate business abroad, using a tourist visa invalidates your NRI claim and makes you a resident for tax purposes, liable to pay income tax on your global income in India.

To stay compliant with Indian tax laws and avoid unnecessary tax on your global earnings, follow these steps:

1. Use the Correct Visa Type

Always travel on a business or employment visa when leaving India for commercial or professional purposes. The visa type must clearly reflect your intent.

2. Maintain Proof of Purpose

3. Monitor Your Days in India

Use a tax residency calculator to track your presence in India and determine your residential status every year.

4. Understand Global Taxation Rules

If you are a resident, India taxes you on:

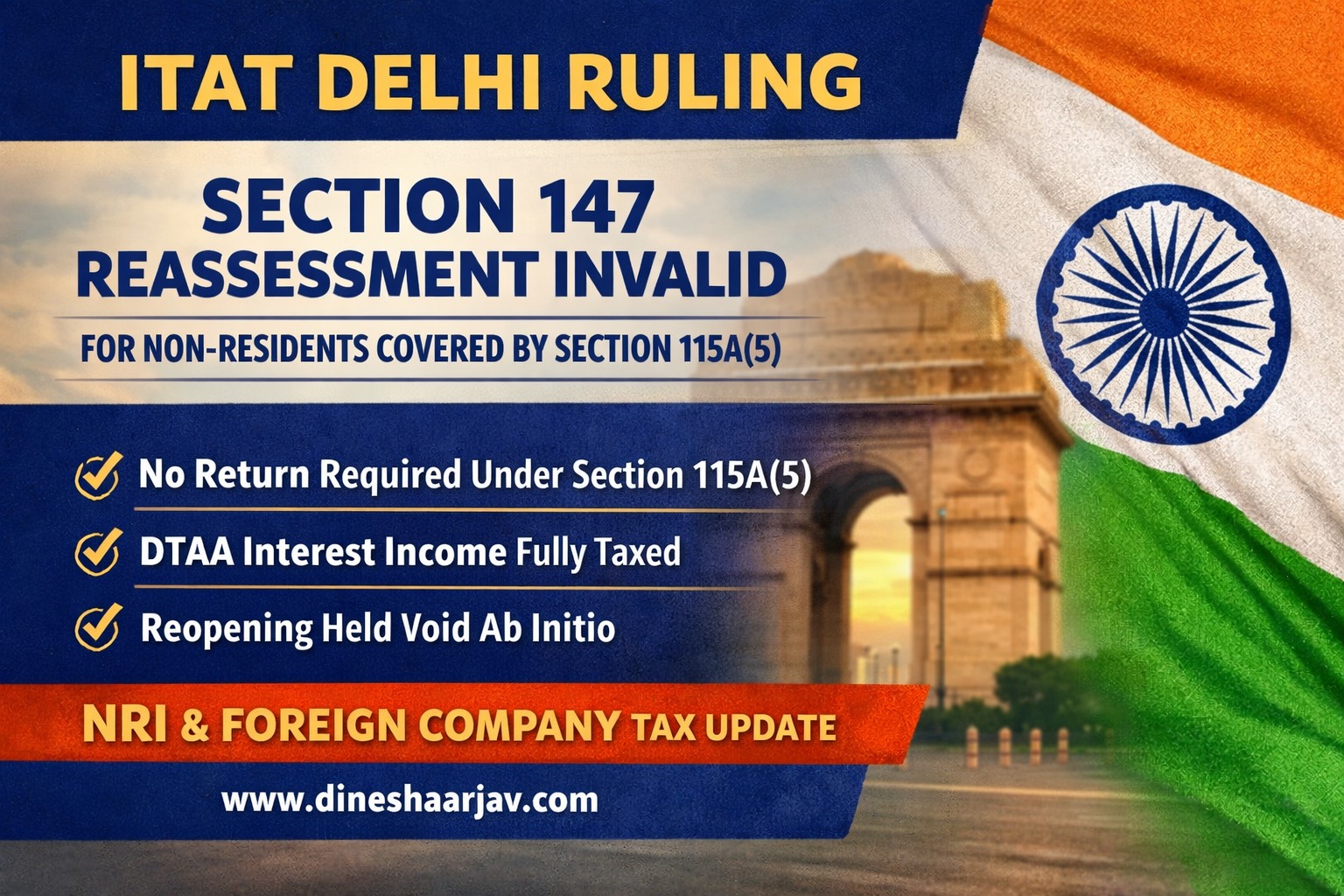

Avoid becoming a resident unknowingly—it can result in double taxation unless you're protected by a Double Taxation Avoidance Agreement (DTAA) or guided by professional DTAA consultancy.

5. Work with NRI Tax Experts

Navigating global tax laws, FEMA, DTAA, and Indian tax residency can be complex. Consult experts to stay compliant and avoid tax penalties.

The ITAT ruling is a game-changer. It proves that the Indian tax department closely scrutinizes the visa type, travel purpose, and documentation when evaluating NRI claims.

Even if you're physically out of India for 183+ days, you may still be taxed as a resident if you didn’t leave for a valid business or employment reason under the correct visa.

At Dinesh Aarjav & Associates, we specialize in providing NRI consultancy services tailored to meet the unique financial and compliance needs of non-resident Indians. Our expertise includes::

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.