WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

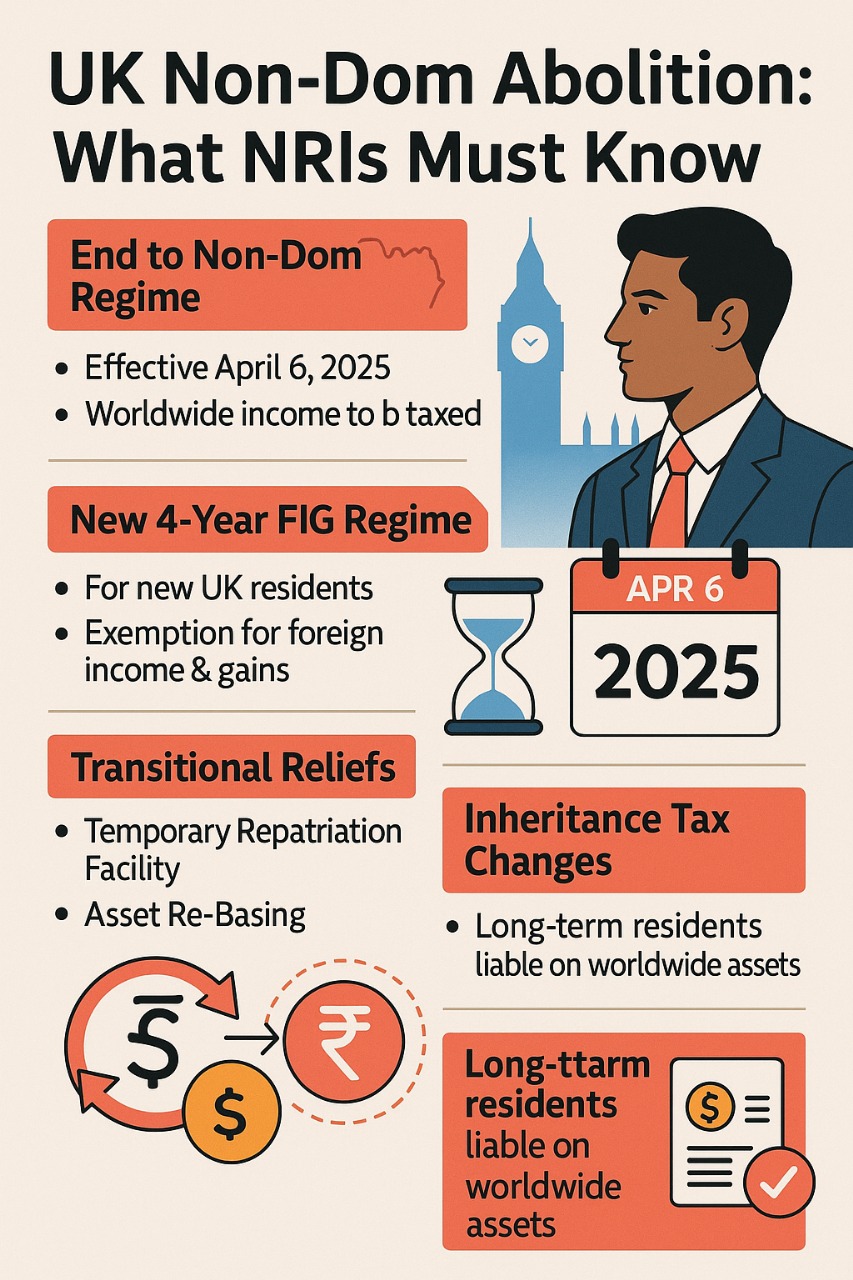

For decades, the UK’s non-domicile (non-dom) system has been one of the most attractive tax structures for globally mobile individuals — especially NRIs who maintain significant assets, income, and investments in India. But beginning 6 April 2025, the UK is completely abolishing the non-dom regime and replacing it with a new Foreign Income and Gains (FIG) regime, rewriting tax obligations for every UK resident with worldwide income.

This is not a minor policy shift — it is one of the biggest tax restructurings in modern UK history. For NRIs, it reshapes the way Indian investments, property income, NRE interest, business profits, and foreign capital gains will be taxed.

If you are:

you must understand these changes in detail and update your tax planning strategy accordingly.

This blog breaks down the new rules, their impact, real planning opportunities, and how NRIs can respond strategically before April 2025.

The “non-dom” system allowed individuals who lived in the UK but whose permanent home (domicile) was elsewhere to choose the remittance basis.

Under this system, NRIs paid UK tax only on:

And they did not pay UK tax on:

As long as the money stayed outside the UK, it was not taxed.

This regime was especially beneficial for NRIs with high-value investment portfolios, real estate, business income, or asset sales in India.

But from 6 April 2025, this rule disappears permanently.

From April 2025 onward:

All UK residents will be taxed on worldwide income and gains — regardless of domicile status.

This includes:

The UK is shifting to a residence-based system, meaning that simply being resident in the UK subjects you to global taxation.

This change impacts nearly 74,000 current non-doms, including thousands of NRIs.

A major opportunity for NRIs moving to the UK after a long gap

The FIG regime offers a 4-year exemption on most foreign income and gains — but only for qualifying individuals.

You can qualify if:

What foreign income & gains are eligible?

What is NOT covered?

Important considerations:

When you claim the FIG regime, you lose:

This means FIG is beneficial mainly for wealthy NRIs with high foreign income, but less beneficial for those with modest income streams.

If you are already living in the UK and have used the remittance basis in the past, two major transitional reliefs apply.

These are some of the biggest NRI tax planning opportunities NRIs have before the rules change.

4.1 Temporary Repatriation Facility (TRF): Pay Just 12%–15% UK Tax Instead of Full Rates

This facility allows you to bring foreign income and gains earned before April 2025 into the UK at reduced tax rates:

This is available if you claimed the remittance basis even once.

TRF is highly valuable for NRIs who have:

The best part?

You can designate the funds (triggering tax) without remitting immediately. Actual remittance can occur later.

This helps avoid forced asset sales or liquidity stress.

4.2 Asset Re-Basing to 5 April 2017 Value

For eligible NRIs, foreign assets will be treated as acquired at their 2017 market value when sold after 6 April 2025.

This can dramatically reduce capital gains tax exposure — especially on long-term Indian real estate or large investment portfolios.

Many wealthy NRIs use Indian, UAE, or offshore trusts for succession planning. These structures are heavily impacted.

New rules include:

If you or your family have existing trusts — even if offshore — you should review the structure immediately.

The UK is replacing the domicile concept for IHT with the Long-Term Resident test.

You become a Long-Term Resident if:

Once you meet this threshold:

You become liable to UK Inheritance Tax (IHT) on your worldwide estate, not just UK assets.

This includes:

Even after you leave the UK:

Your IHT exposure may continue for 3 to 10 years, depending on your total years of residence.

This is one of the most consequential changes for wealthy NRIs.

The UK–India DTAA (Double Taxation Avoidance Agreement) remains in effect and provides:

To claim these benefits, NRIs should maintain:

This is where you can actually optimize your tax position.

Before April 2025:

When you return to India permanently, your residential status doesn’t change immediately.

You may qualify as Resident but Not Ordinarily Resident (RNOR) for 2–3 years if:

RNOR Benefits:

Combine RNOR + UK transitional relief

This creates one of the most tax-efficient repatriation windows ever for nri returning to india between 2025–2027.

Q1. Is the UK Non-Dom regime ending?

Yes, completely from 6 April 2025.

Q2. What is the new FIG regime?

A 4-year exemption for foreign income and gains for new UK residents.

Q3. Will UK residents be taxed on Indian income?

Yes — from April 2025, all worldwide income becomes taxable.

Q4. What is the Temporary Repatriation Facility?

A 12–15% tax rate on bringing pre-2025 foreign income/gains into the UK.

Q5. Do NRIs need to rethink inheritance planning?

Yes — IHT now applies based on long-term residence, affecting worldwide assets.

Q6. What should NRIs do immediately?

Review structures, plan repatriation, evaluate FIG eligibility, and prepare before April 2025.

The abolition of the non-domicile regime transforms how NRIs in the UK will be taxed on Indian income, global investments, foreign assets, and inheritance. The shift to worldwide taxation, the new FIG regime, IHT residency rules, and trust reforms create both risks and opportunities.

Your tax planning today will determine your financial efficiency for the next 10–20 years.

At Dinesh Aarjav & Associates, we specialise in:

A personalised consultation ensures you avoid unnecessary taxation and maximise relief before these sweeping new rules take effect.

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.