WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

Selling property abroad can be financially rewarding — but it also comes with tax implications in the UK. Whether you are a UK resident, NRI, or an expatriate returning to the UK, understanding how Capital Gains Tax (CGT) applies to your overseas property sale is essential before bringing the funds back home.

Below, our experts at Dinesh Aarjav & Associates answer the most frequently asked questions about UK Capital Gains Tax on overseas property, double taxation relief, and reporting requirements, helping you stay compliant and optimise your global tax position.

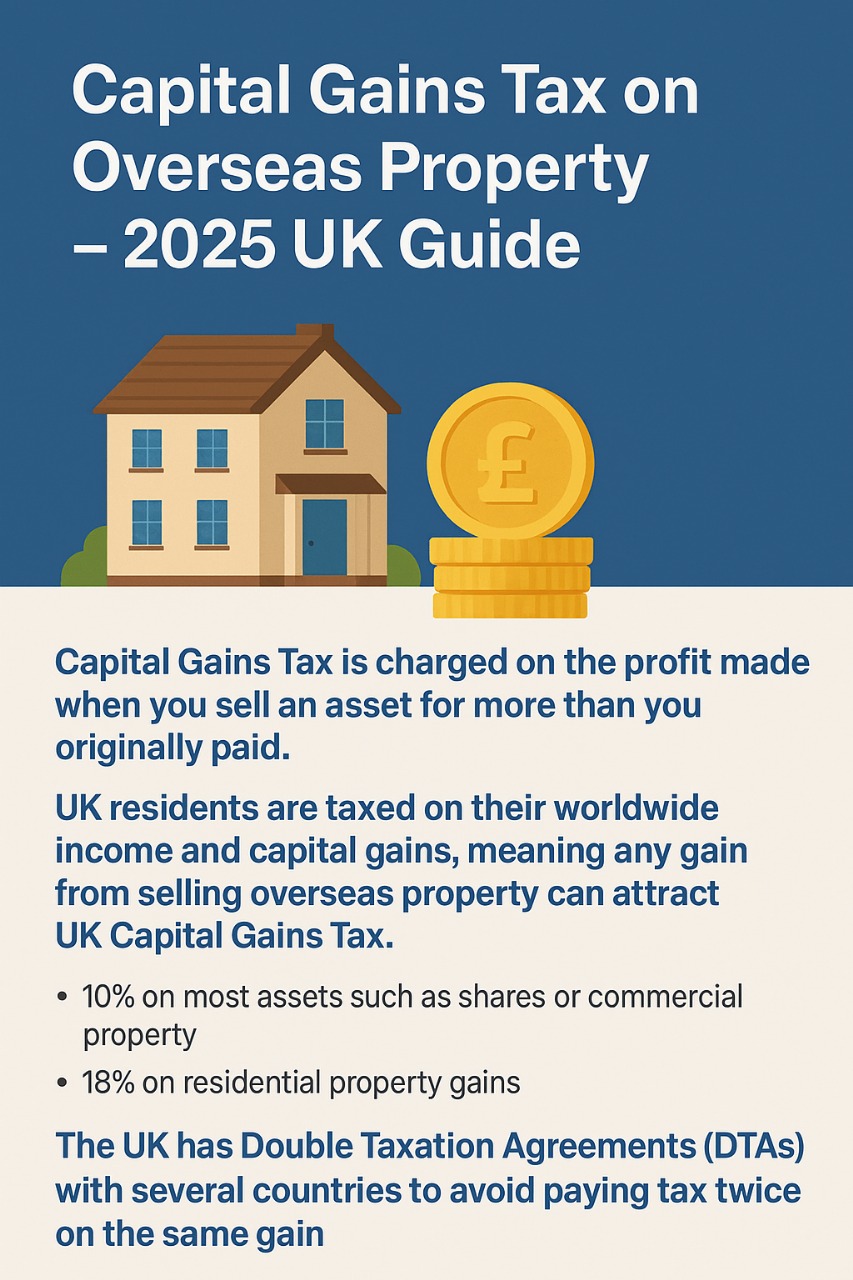

Capital Gains Tax (CGT) is charged on the profit made when you sell an asset for more than you originally paid. For UK residents, this includes not only UK property but also overseas properties and foreign investments.

In simple terms, if you sell a house, flat, or investment property abroad and make a profit, that gain may be taxable in the UK — even if the asset was located outside the country.

This rule applies whether you are selling:

Yes. UK residents are taxed on their worldwide income and capital gains, meaning any gain from selling overseas property can attract UK Capital Gains Tax.

Even if the property is sold abroad, the UK tax liability arises when:

Non-residents generally pay CGT only on UK property, but UK residents are taxed globally.

The CGT rate depends on your income tax band and the type of property sold.

For Basic Rate Taxpayers:

For Higher & Additional Rate Taxpayers:

Example:

If you sell a flat in Dubai for a profit of £80,000 and you fall into the higher tax bracket, you could owe up to 28% UK CGT on that gain after applying reliefs and exemptions.

Every individual gets a CGT Annual Exemption (£3,000 for 2025/26 as per current limits).

This means that the first £3,000 of total gains across all disposals during the year is tax-free.

If your combined gains exceed this limit, CGT applies only to the taxable balance.

Not necessarily. The UK has Double Taxation Agreements (DTAs) with several countries to avoid paying tax twice on the same gain.

If you have already paid foreign capital gains tax in the country where the property is located, you can usually claim Foreign Tax Credit Relief in your UK tax return.

This ensures you only pay the higher of the two tax amounts — not both in full.

For example:

If you sold property in Spain and paid 19% local CGT, and your UK CGT rate is 28%, you would generally only pay the 9% difference to HMRC.

You must report and pay CGT on overseas property through your Self Assessment tax return.

Unlike UK residential sales (which must be reported within 60 days), foreign property sales are reported:

Be sure to:

You can deduct certain allowable expenses from your sale proceeds to reduce your taxable gain, such as:

Proper documentation of these costs can significantly lower your UK CGT liability.

Here are a few expert tips from our team:

Keep all transaction records – purchase documents, exchange rate details, and evidence of payments.

Know local tax laws – some countries charge additional local or municipal capital gains taxes.

Use DTAs effectively – claim foreign tax credits where possible.

Seek professional advice early – cross-border tax planning can help minimise exposure before selling.

Disclose correctly – undeclared overseas gains can lead to HMRC penalties or inquiries.

When repatriating funds from abroad, it’s crucial to ensure that:

HMRC may question unexplained large transfers. Having proper documentation, tax payment proofs, and property sale contracts ensures smooth transfer and compliance.

Let’s say you sell a property in the UAE:

Purchase Price: £250,000

Sale Price: £400,000

Gain: £150,000

If UAE imposes no CGT, the entire gain is taxable in the UK.

If the property was in France and you paid 19% French CGT, you’ll get credit relief for that 19% against your UK liability of 28%.

So, you’d only pay the difference of 9% to HMRC.

International property transactions can be complex — involving exchange rate fluctuations, local tax rules, and DTA claims.

Our team at Dinesh Aarjav & Associates specialises in UK–India–Global Tax Advisory, assisting NRIs, expatriates, and UK residents with:

Selling an overseas property is more than just a financial decision — it’s a tax event.

By understanding how UK Capital Gains Tax on overseas property works, claiming the right double taxation relief, and ensuring timely reporting, you can keep more of your profits legally and efficiently.

For tailored advice on cross-border property sales and international tax planning, connect with our experts at Dinesh Aarjav & Associates — a 25+ year-old Chartered Accountancy firm specialising in global taxation and NRI tax consultancy.