A lot of Indians invest in foreign stocks especially in the stocks listed on US stock exchanges without realizing the hassle of handling the complexity in filing the return in India. With the Income Tax Return ITR deadline approaching near for individuals, here is everything you should know if one is holding any foreign assets.

What needs to be disclosed and how?

- All foreign asset such as foreign stocks, real estate, bank accounts, bank deposits, insurance policies and other financial assets need to be disclosed in the ITR filed in India.

- So, even an individual who has a taxable income below the basic exemption limit of ₹2.5 lakh but holds any foreign stock will still need to file the ITR just to disclose this stock holding.

- Foreign assets are declared in schedule FA (Foreign Assets) in ITR-2 or ITR-3 and the values are to be declared in INR after conversion and not in the foreign local currency.

- Also, ITR forms require disclosures of assets held at any time during the previous calendar year. For instance, while filing ITR for the assessment year 2023-24, you will need to declare foreign assets held from 1 January 2022 to 31 December 2022.

What are the disclosure requirements?

- Disclosing ownership of foreign assets and reporting income from those assets are two different requirements in the ITR.

- Dividend is to be declared at two places in the ITR. One being ‘income from other sources’. And the second being, when one declares equity shares in schedule FA, there’s a section that asks whether one has earned income on this asset. One has to disclose the dividend payout here as well. It has to be declared at both places irrespective of its reinvestment.

- The same applies to shares as well. In the year a stock is sold, the sale proceeds should be declared in the FA schedule under ‘total gross proceeds from sale or redemption of investment during the period’. Also, the full details also need to be reported under the capital gains section separately.

How do we tax?

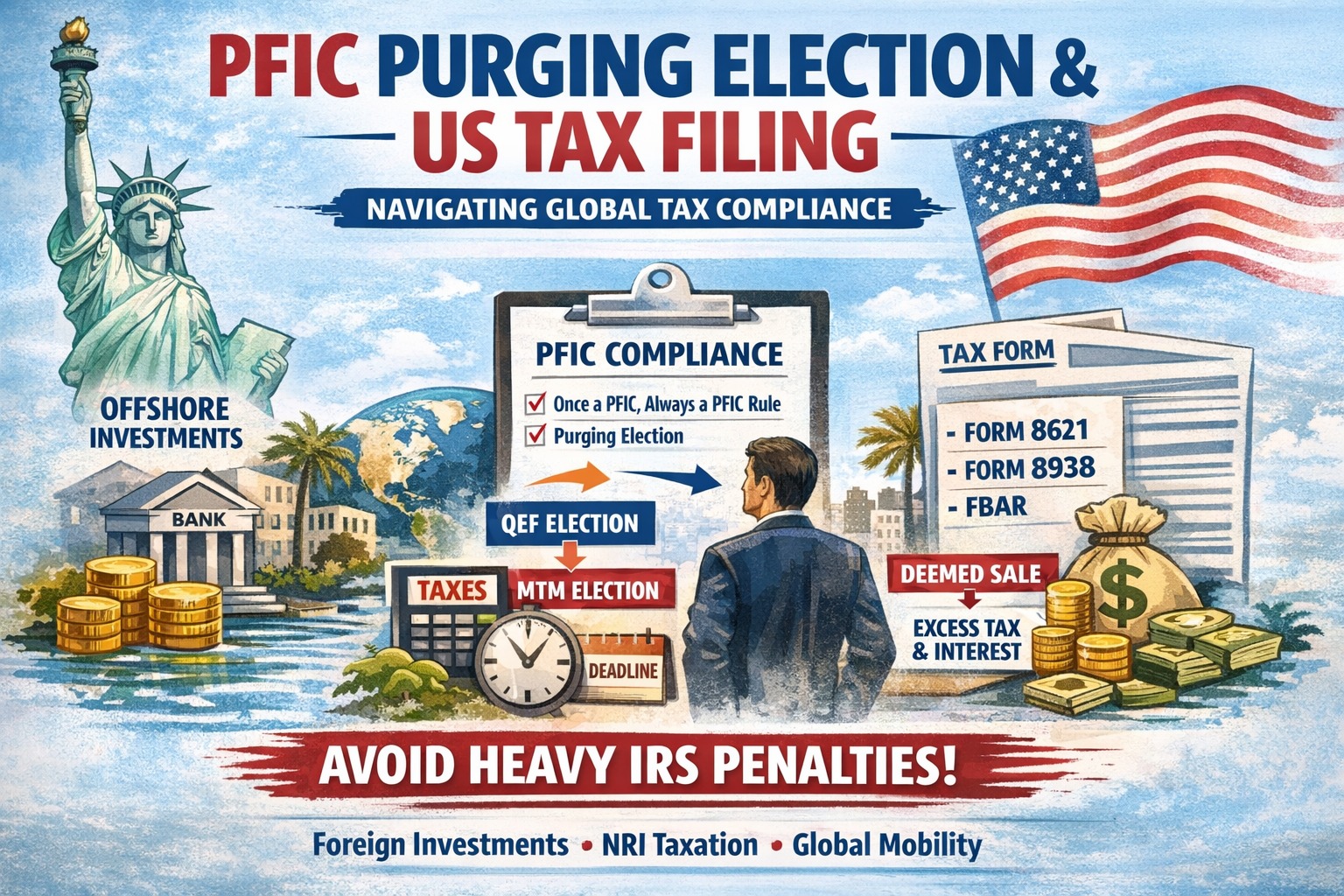

- When a foreign stock is sold after 2 years, the gains made from it are treated as LTCG, and taxed at 20% (surcharge extra), with indexation benefit, in India. STCG are taxed at one’s income tax slab rates.

- Dividend income earned on foreign shares is taxed at tax slab rates in India. In the US, when the dividend is paid, a flat 25% is withheld as tax. India has DTAA with the US through which one can claim the tax paid in the US by filling up the form 67 to offset tax liability in India at the time of filing ITR. Dividend is taxable in the year of accrual and does not necessarily depend on repatriation of the same in India.

What happens if you fail to disclose?

- Can be scrutinized by the tax department under the Black Money (Undisclosed Foreign Income and Assets) & Imposition of Tax Act, 2015.

- The Foreign Asset Investigation Unit (FAIU) will investigate information received from foreign jurisdictions under the Tax Information Exchange Agreements (TIEA).

- Penalized with ₹10 lakh penalty for each of the years of default.

WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community