WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

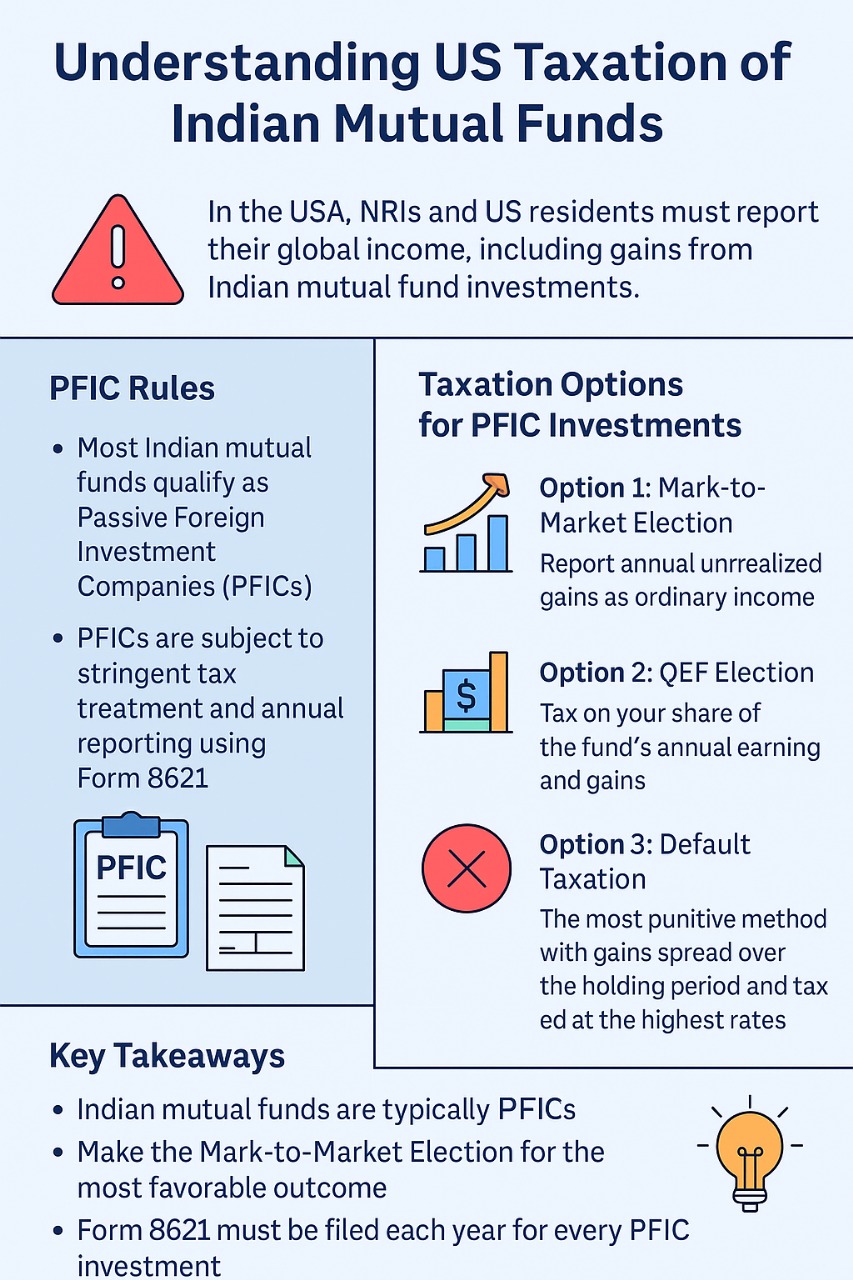

Are you a US resident or citizen holding Indian mutual funds? You could be triggering unexpected tax liabilities under the IRS PFIC rules. Here’s a complete guide on how Indian mutual fund investments are taxed in the USA, what the PFIC rules mean for you, and the actions you need to take to avoid heavy penalties and interest.

While Indian mutual funds are a popular investment avenue, especially for NRIs and OCIs, the tax treatment of these funds in the USA is starkly different. In India:

However, if you’re a US person for tax purposes—including Green Card holders, US citizens, and tax residents—the IRS expects you to report and pay tax on your global income, including gains from Indian mutual funds.

The catch? Most Indian mutual funds are considered PFICs (Passive Foreign Investment Companies) under US tax law, which come with strict compliance requirements and potentially punitive tax treatment.

The IRS uses the PFIC classification to deter US taxpayers from investing in offshore funds that don't distribute income regularly (thus deferring taxes). Indian mutual funds generally meet the PFIC criteria:

Once classified as PFIC, your Indian mutual fund investments are subject to special tax treatment, and Form 8621 must be filed each year for every PFIC investment you hold.

Form 8621 is the IRS disclosure form for each PFIC holding. If you invest in Indian mutual funds while living in the US, you're required to submit this form annually—regardless of whether you've made any gains or received distributions.

Depending on your choice of election, you’ll be taxed in one of three ways:

This is the most commonly used and IRS-compliant method for reporting PFICs like Indian mutual funds.

Key Benefit: Spreads your tax burden over time and avoids the painful default method.

Best used when you become a US tax resident—make this election in your first US tax return to lock in favorable treatment.

Under this option, your Indian mutual fund is treated like a US partnership—you report your proportionate share of earnings and gains each year.

However, this requires cooperation from the Indian fund house, which must provide annual statements showing your income. Since most Indian AMC platforms don’t provide QEF data, this option is rare for Indian mutual funds.

If you don’t make an election, the IRS taxes you using the most punitive PFIC method:

For example: You held Indian mutual funds for 10 years and sold for a $100 gain. IRS will treat it as $10/year gain, tax each year at top rates, and charge interest on unpaid taxes—creating a massive tax liability.

If you're in the US for only a couple of years on a temporary assignment, and you plan not to redeem your Indian mutual fund units, you might think skipping Form 8621 is safe.

However, the IRS has proposed a new rule: if a person holding PFICs gives up US residency or citizenship, they are deemed to have sold all PFIC holdings on their final day as a US person—triggering full tax liability retroactively.

Translation: Even if you plan to leave the US, the IRS may tax you as if you sold your Indian mutual funds before you left.

At Dinesh Aarjav & Associates, we specialize in:

Whether you’re newly moved to the US, planning to relocate, or reviewing your India-based investments for US tax impact—our experts can help you stay compliant while optimizing your tax exposure through specialized NRI advisory services.

Reach out to us for a consultation on your PFIC reporting obligations and US tax return filing services involving Indian mutual funds.

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.