WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

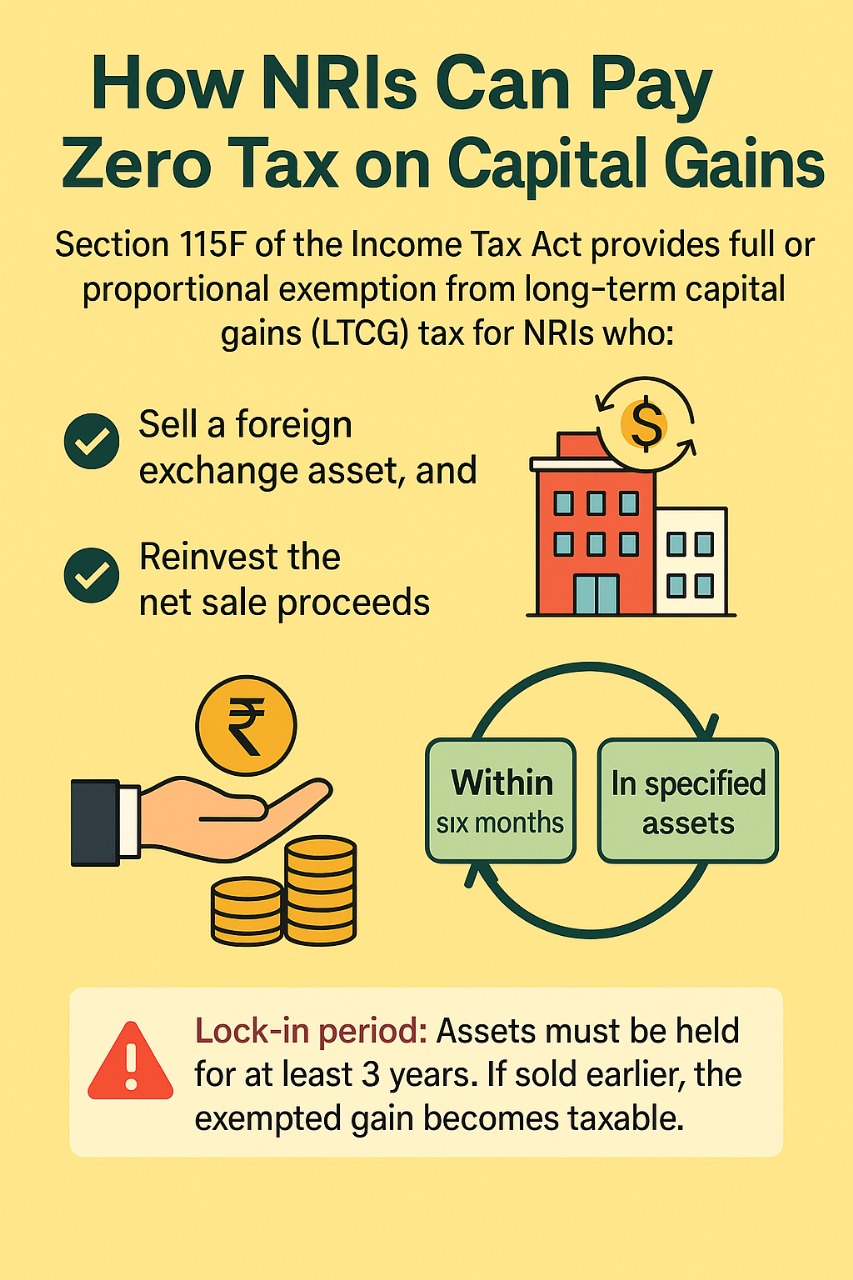

Looking for ways to avoid paying capital gains tax as an NRI in India? You’re not alone. Many Non-Resident Indians (NRIs) are unaware that the Indian Income Tax Act offers a completely legal provision Section 115F that allows you to pay zero tax on long-term capital gains (LTCG) if certain conditions are met.

This guide breaks down everything you need to know about how NRIs can save tax on capital gains by reinvesting under Section 115F. Let’s dive in.

Section 115F offers long-term capital gains exemption to NRIs when they:

This section is specifically applicable to Non-Resident Indians, making it a highly effective tax planning tool for cross-border investors.

As per Indian tax law, a foreign exchange asset is any long-term capital asset acquired using convertible foreign exchange (like funds from your NRE, FCNR, or foreign remittance channels).

Common foreign exchange assets include:

These assets must be held for more than 12/24 months to qualify as long-term under tax rules.

To claim tax exemption under Section 115F, NRIs must reinvest the full net sale proceeds (not just the profit) into the following:

Not allowed: Reinvestment in mutual funds, real estate, ULIPs, private companies, or gold does not qualify for exemption under this section.

To maintain the exemption, the new asset purchased using the capital gains must be held for a minimum of 3 years. If you sell or transfer this reinvested asset before 3 years, the earlier tax-exempt capital gain becomes fully taxable in the year of sale.

The exemption is allowed proportionately, based on the reinvestment amount.

Formula for Exempt Capital Gain:

Exempt LTCG = (Amount Reinvested ÷ Net Sale Value) × Total Long-Term Capital Gain

Let’s assume:

Sale value of listed equity shares: ₹6 crore

Original cost of investment: ₹3 crore

Total long-term capital gain: ₹3 crore

Reinvestment in eligible asset: ₹4.5 crore

Exempt Capital Gain = (₹4.5 crore / ₹6 crore) × ₹3 crore = ₹2.25 crore

Taxable LTCG = ₹3 crore – ₹2.25 crore = ₹75 lakh

Tax Saved:

Assuming a 20% LTCG tax rate (post indexation), NRI saves:

₹2.25 crore × 20% = ₹45 lakh in tax saved.

The reinvestment must be made within 6 months of the transfer of the asset. Delay in reinvestment disqualifies you from claiming exemption.

You must reinvest only in assets permitted under Section 115F. Any investment in property, unlisted shares, mutual funds, or international assets will not help you save tax under this section.

The reinvested asset must be held for at least 36 months. Premature sale leads to revocation of the exemption, and tax will be levied on the exempted amount.

Reinvestment should be made using foreign exchange (through NRE/FCNR account or foreign remittance).

Retain bank records, FIRC certificates, and investment documents to prove compliance during assessment.

Tax laws for NRIs in India are complex, but when used strategically, provisions like Section 115F can result in massive tax savings.

This is not tax evasion. It is lawful tax optimization.

If you're planning to sell Indian assets and want to maximize your post-tax returns, speak to an expert NRI tax consultant before executing the transaction.

At Dinesh Aarjav & Associates, we specialize in: