WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

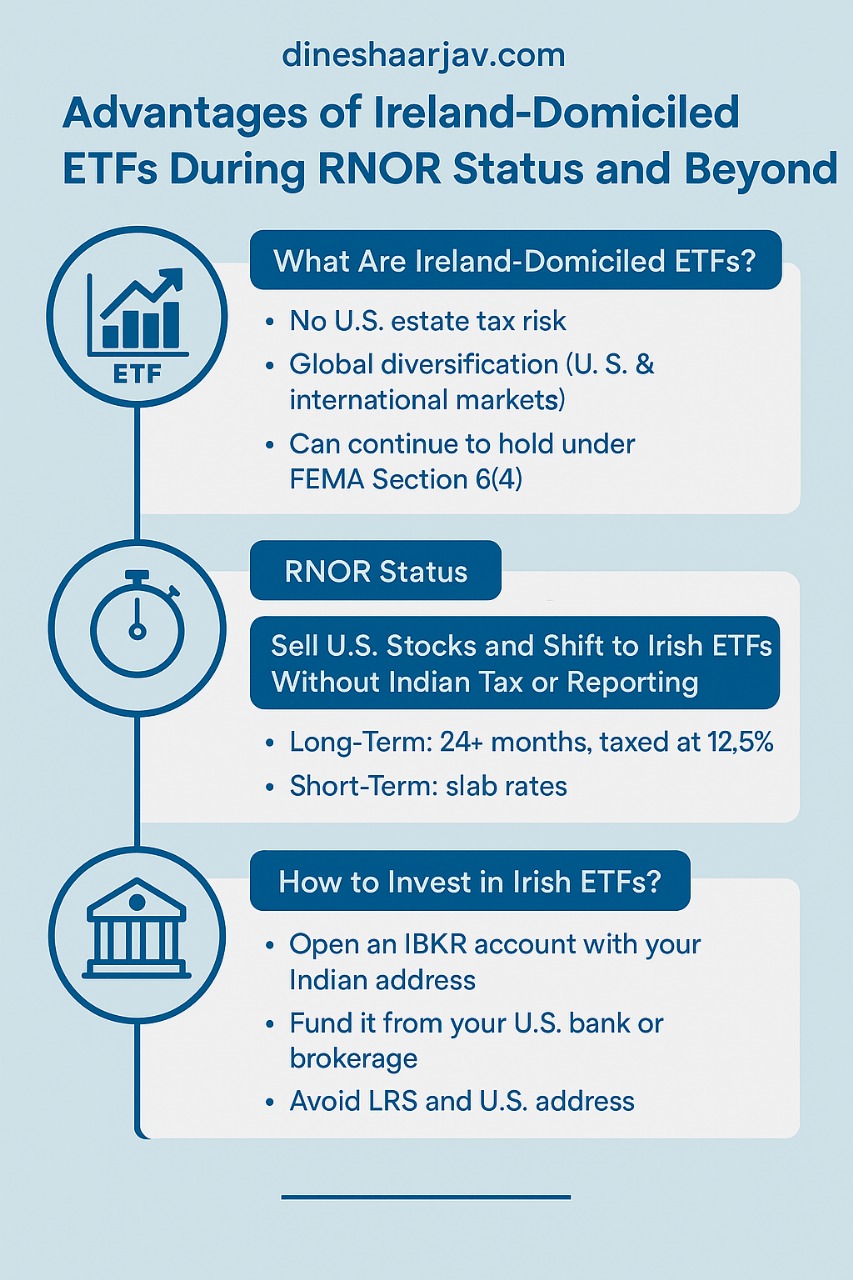

If you're an NRI returning to India, managing your global investment portfolio can feel complicated—especially when balancing foreign assets, tax compliance, and FEMA regulations. One smart and increasingly popular option is investing in Ireland-domiciled Exchange-Traded Funds (ETFs). These ETFs offer strategic advantages for NRIs, particularly during the RNOR (Resident but Not Ordinarily Resident) phase, and even after becoming a full Resident and Ordinarily Resident (ROR).

In this blog, we’ll explain:

Ireland-domiciled ETFs are funds registered in Ireland that offer exposure to U.S. and global stock markets, without being directly domiciled in the United States.

Key Advantages for NRI Investors:

When NRIs return to India, they can claim RNOR status for up to three years. During this time, they are:

Strategic Use of RNOR Status:

This makes RNOR status the ideal phase to restructure your global ETF portfolio.

Once your RNOR period ends, you become a Resident and Ordinarily Resident (ROR) in India. From this point onward, Indian income tax laws fully apply to your global income and capital gains.

Tax Rules for Ireland ETFs as ROR:

Even after RNOR, Ireland domiciled ETF continue to offer global diversification, low tax rates, and no U.S. estate tax risk, making them ideal for long-term investors living in India.

One of the most frequently asked questions by NRIs is—How to invest in Ireland-domiciled ETFs legally and efficiently from India?

Here’s the best route:

Best Practice for NRI Investment:

Avoid These Common Mistakes:

Under FEMA Section 6(4), NRIs who return to India are allowed to continue holding foreign assets acquired while they were non-residents. This includes:

So, if you're in your RNOR window, there's no obligation to bring your funds back to India. You're also not required to report these assets in Indian tax returns, making it a highly tax-efficient strategy.

| Criteria | RNOR Status | Resident (ROR) Status |

| Tax on Foreign ETF Gains | Not Taxable in India | Taxable: LTCG at 12.5%, STCG as per slab |

| Reporting of Foreign Assets | Not Required | Mandatory under Schedule FA |

| Estate Tax Risk | None (unlike U.S. ETFs) | None |

| Recommended Investment Mode | IBKR India account funded from U.S. bank | Same |

| Use of LRS Route | Not recommended | Still not ideal due to limits & paperwork |

At Dinesh Aarjav & Associates, we help NRIs, OCIs, and expatriates navigate the transition to India with:

With over 25 years of experience and clients across the U.S., UK, UAE, Australia, and Canada, we provide tailored NRI advisory services designed to ensure full compliance and wealth preservation.

Contact us today to discuss your RNOR phase, foreign investments, and cross-border NRI tax planning.

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.