In a landmark international tax ruling, the Income Tax Appellate Tribunal (ITAT), Bangalore delivered a crucial decision in the case of Binny Bansal vs Deputy Commissioner of Income Tax (International Taxation) for Assessment Year 2020–21.

This judgment has become a defining precedent for NRI tax residency, overseas relocation planning, India–Singapore DTAA interpretation, and taxation of offshore startup exits. With hundreds of Indian startup founders, CXOs, and investors relocating to Singapore, UAE, USA, and Europe, the Binny Bansal case has emerged as a must-know ruling for cross-border tax planning.

The decision examines:

- How Indian tax law determines residential status

- Meaning of “being outside India” under Section 6

- Application of India–Singapore DTAA tie-breaker rules

- Taxability of capital gains from offshore holding company share sales

- Procedural validity of draft assessment orders for non-residents

Case Background: Flipkart Founder’s Move to Singapore

Assessee: Shri Binny Bansal

Forum: ITAT Bangalore “C” Bench

Assessment Year: 2020–21

Dispute: Whether the assessee was Resident in India or Non-Resident during FY 2019–20

Key factual timeline:

- Co-founder of Flipkart

- Resigned from Flipkart India in November 2018

- Took up employment in Singapore from February 2019

- Joined Three State Capital Advisors, Singapore

- Relocated family to Singapore

- Obtained Singapore Employment Pass

- Continued working and residing in Singapore through FY 2019–20

During FY 2019–20:

- Stayed 141 days in India

- Sold Flipkart Private Limited (Singapore) shares in multiple tranches

- Filed Indian tax return as a Non-Resident

- Claimed exemption of capital gains under India–Singapore DTAA

Key Legal Questions Before ITAT

- Is Binny Bansal a Non-Resident under Indian Income Tax Act?

- Does “being outside India” in Explanation 1(b) to Section 6 require prior non-resident status?

- Does the India–Singapore DTAA treat him as Singapore tax resident?

- Are capital gains from sale of Flipkart Singapore shares taxable in India?

- Was the draft assessment procedure valid?

These questions lie at the heart of NRI residency tax disputes in India.

Assessing Officer’s Findings: Resident in India

The Assessing Officer (AO) held:

- Stay in India exceeded 365 days in preceding four years

- Stay in India in FY 2019–20 was 141 days

- Therefore became Resident under Section 6(1)(c)

AO’s interpretation:

- Explanation 1(b) (“being outside India”) applies only to existing NRIs

- Since assessee was resident in prior years, benefit of 182-day threshold unavailable

- Hence classified as Resident and Ordinarily Resident

AO further denied DTAA benefits:

- Permanent home allegedly in India

- Economic interests tied to Indian startup ecosystem

- Habitual abode in India

As a result:

- Capital gains on Flipkart Singapore share sale taxed in India

- Income assessed above ₹1,800 crore

DRP Order: Upholding Indian Residency

The Dispute Resolution Panel (DRP):

- Upheld AO’s view that Explanation 1(b) benefits only non-residents

- Confirmed Indian residency status

- Denied India–Singapore DTAA tie-breaker relief

Partial relief granted only for:

- Share transfer expense deduction

- Forex conversion correction

- Section 80G deduction

Assessee’s Arguments Before ITAT

1. Non-Resident under Section 6

The assessee argued:

- Explanation 1(b) uses phrase “being outside India”

- This does not mean “being non-resident”

- Any Indian citizen outside India for employment qualifies for 182-day threshold

- Since he stayed only 141 days, he is Non-Resident

Alternatively:

- Explanation 1(a) applies to citizens leaving India for employment abroad

- Therefore also entitled to 182-day rule

This interpretation directly impacts NRI tax residency determination.

2. Singapore Residency under DTAA

Even if dual residency existed:

- Permanent home in Singapore

- Family, children, spouse residing in Singapore

- Employment in Singapore

- Social and economic life centered in Singapore

Hence under Article 4(2) tie-breaker of India–Singapore DTAA, he must be treated as Resident of Singapore.

3. Capital Gains Exemption on Flipkart Singapore Shares

Assessee claimed:

- Flipkart Private Limited is a Singapore holding company

- Capital gains exempt under Article 13(5) of India–Singapore DTAA

Alternatively exempt under Explanation 7(a) to Section 9(1)(i) since:

- Shareholding <5%

- No voting or management control

- No controlling interest

This point is critical for startup founders holding offshore entities.

4. Invalid Draft Assessment Order

AO held assessee as Resident, yet issued:

- Draft Assessment Order under Section 144C

Draft orders apply only to eligible assessees (non-residents / transfer pricing cases).

Therefore:

- Procedure was invalid

- Final assessment order time-barred

- Entire order void in law

This procedural ground is significant in international tax litigation.

Revenue’s Counter-Arguments

Revenue contended:

- Explanation 1(b) intended only for existing NRIs

- “Being outside India” synonymous with “non-resident”

Indian property, business ties, and past residency establish:

- Permanent home in India

- Centre of vital interests in India

- Habitual abode in India

Thus Indian residency justified.

Why This Judgment Matters for NRIs

This ruling has far-reaching implications for:

- Indian citizens relocating abroad

- Startup founders shifting headquarters overseas

- CXOs and professionals moving to Singapore / UAE / USA

- NRI investors exiting Indian startups

- Cross-border capital gains tax planning

Key Takeaways:

- Past residency history matters in Section 6 tests

- Employment abroad alone doesn’t guarantee NRI status

- DTAA tie-breaker requires real substance abroad

- Offshore holding company exits need pre-departure tax planning

- Procedural defects can nullify assessments

Implications for Startup Founders & Global Investors

With India’s startup ecosystem increasingly adopting Singapore or Delaware holding structures, this case signals:

- Importance of timing departure from India

- Proper days-in-India tracking

- Establishing genuine overseas tax residency

- Documenting permanent home abroad

- Ensuring DTAA compliance

Failure in residency planning can expose founders to Indian capital gains tax for NRI on global exits.

Expert NRI Tax Advisory from Dinesh Aarjav & Associates

At Dinesh Aarjav & Associates, we specialize in:

- NRI Residency Planning under Section 6

- Advisory for DTAA India–Singapore / DTAA India–UAE / DTAA India USA

- Offshore holding company structuring

- Cross-border capital gains taxation

- International tax litigation support

- Founder relocation tax planning

With 25+ years of international tax experience and global offices, we provide end-to-end NRI tax planning, tax compliance, and relocation solutions.

Conclusion: A Defining Case for NRI Tax Planning

The Binny Bansal ITAT Bangalore ruling has re-shaped the conversation on:

- Indian tax residency law

- DTAA application

- Offshore startup exits

- Founder relocation planning

For NRIs and globally mobile Indians, this case reinforces that residency is a fact-driven test, not merely an intention — and that advance international tax planning is essential before relocating abroad.

Need assistance with NRI residency or DTAA tax planning?

Connect with Dinesh Aarjav & Associates for expert DTAA consultancy.

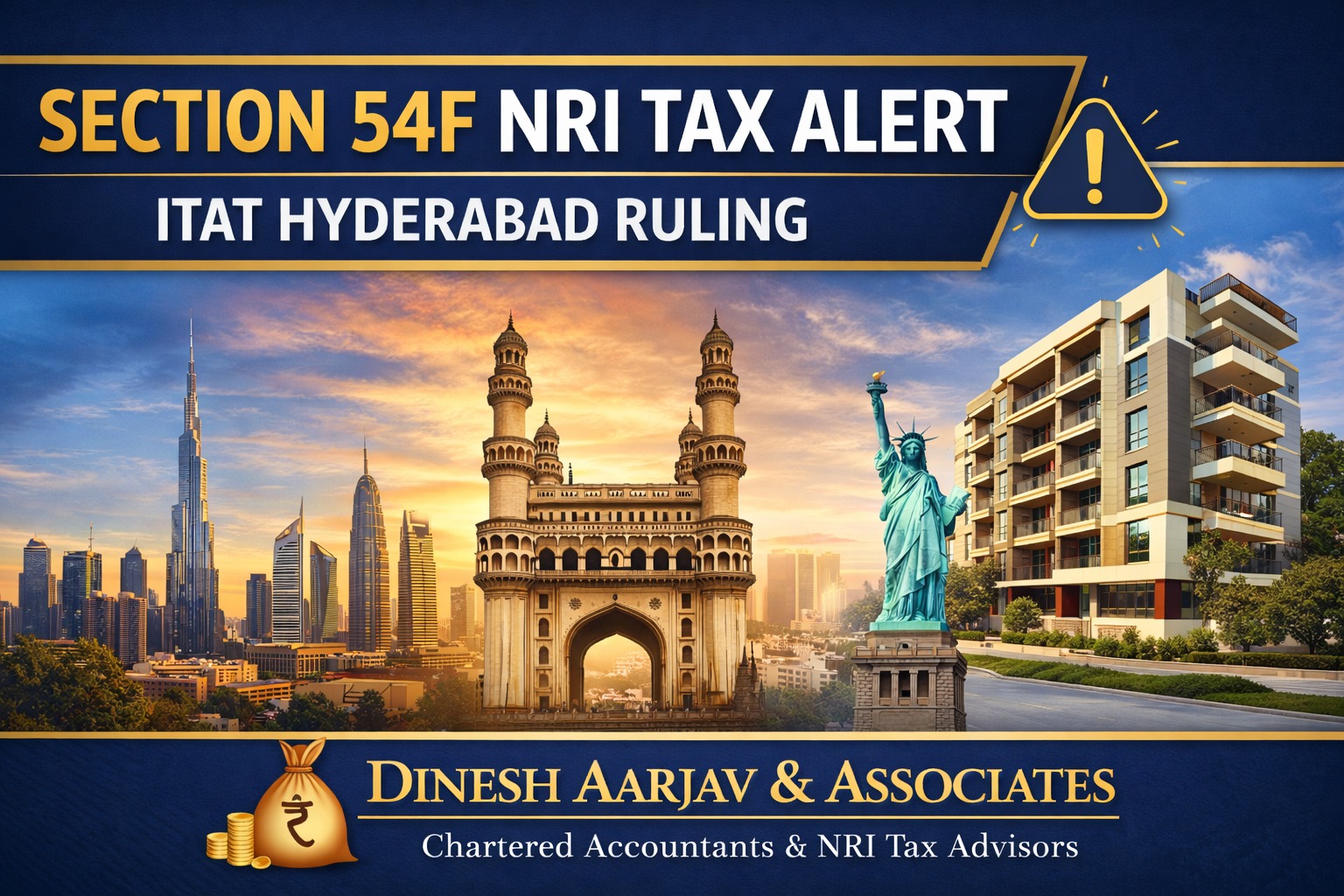

Also Read:

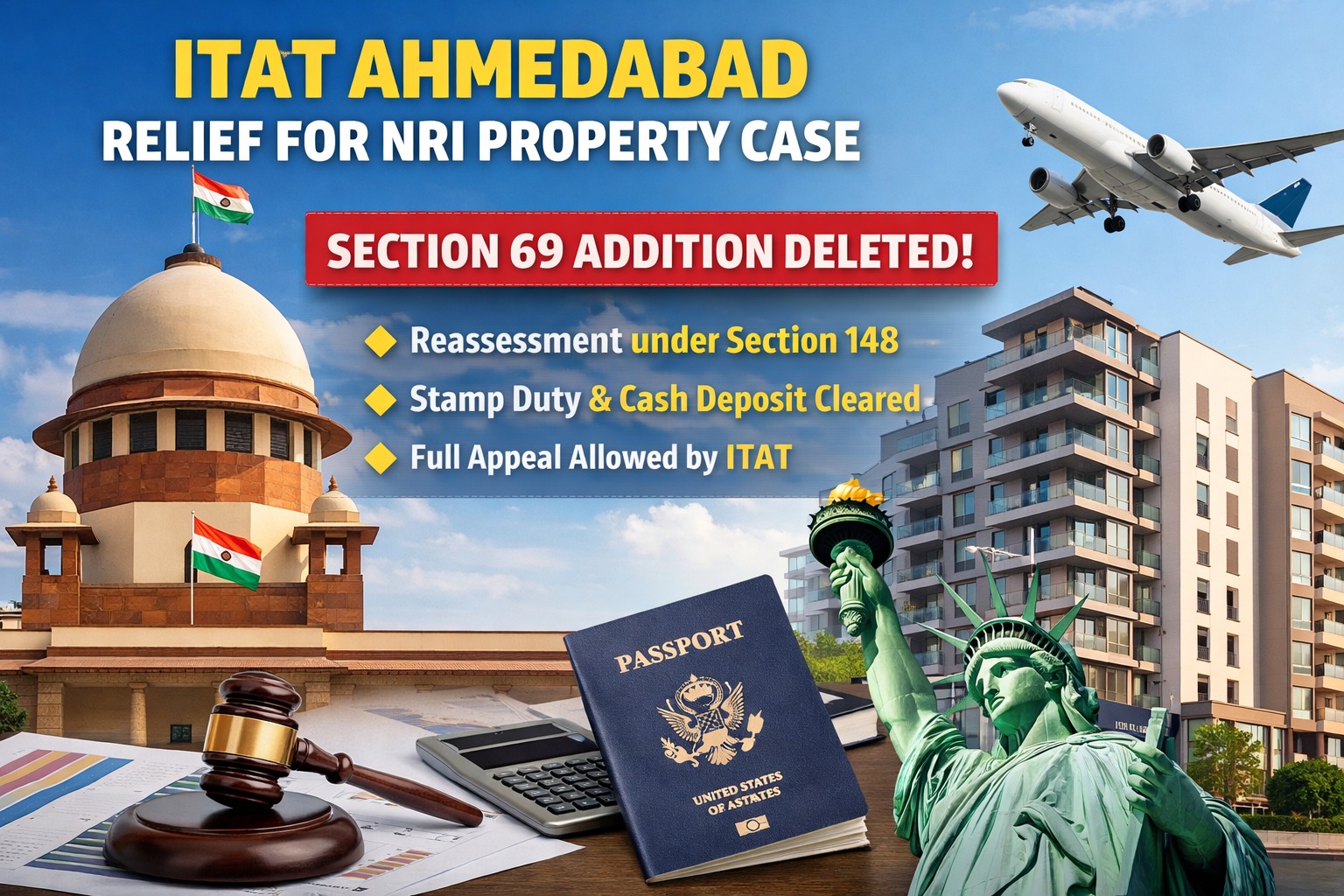

Landmark ITAT Bangalore Ruling on NRI Property Sale: Capital Gains Tax Relief Clarified

ITAT Chennai Ruling on NRI Residential Status: Overseas Income Not Taxable in India for Non-Residents

ITAT Mumbai’s Landmark Ruling: Section 69 Cannot Override Section 5(2)

NRI Tax Status: Mumbai ITAT Ruling on Job Search Abroad & Non-Resident Stay

WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community