WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

At Dinesh Aarjav & Associates (DAA), one of the most common queries we receive from returning NRIs is:

“I moved back to India but continue working for my US employer remotely. Where should I pay tax? Will I be taxed twice? What if I transfer my salary from the US to India?”

With remote work becoming the norm, this situation is increasingly frequent. While it looks simple, it involves complex India–US tax implications, DTAA benefits, foreign asset disclosure, and FEMA compliance.

Here’s a detailed guide based on how we advise our clients in such cases.

a) Salary After Moving to India Is Not US-Sourced

Once you shift to India, the salary you earn while physically in India is India-sourced income. This means it is not taxable in the US, even if your employer is a US company.

b) Avoiding US Withholding with Form 8233

We often see clients with US withholding on their salary. The solution is to submit Form 8233 to your US employer. This ensures no US tax is withheld, as per the India–US DTAA.

Example from our clients:

One client earning USD 12,000 per month was facing a 30% US tax deduction. By filing Form 8233, he stopped unnecessary US withholding and paid tax only in India, saving significant cashflow stress.

c) US Return Filing Requirement

For the year of relocation (say you moved in May 2023), you may need to file a dual-status 1040-NR return because Jan–Apr income was US-sourced.

From the next year onward, if there is no US tax withholding, filing in the US may not be required. Some of our clients still file 1040-NR with zero liability to stay fully compliant.

Once you are living in India, your US salary becomes taxable in India.

a) Salary Taxation in India

The income is taxed under the head “Salaries”, and full disclosure in your Indian return is mandatory.

b) Advance Tax Requirement

Many of our clients assume that since the US employer is deducting tax, they don’t need to pay advance tax in India. This is a mistake.

If your total tax liability exceeds ₹10,000, you must pay advance tax quarterly in India to avoid interest penalties.

Example:

If your annual Indian tax liability is ₹8,00,000, you must pay advance tax in installments across June, September, December, and March. Skipping this results in interest under Sections 234B and 234C.

c) Residential Status and Disclosure

If you qualify as Resident and Ordinarily Resident (ROR), you must disclose all foreign assets (bank accounts, brokerage accounts, etc.) in Schedule FA of ITR-2.

Salary earned after returning to India is India-sourced, so you don’t need to report it in Schedule FSI (Foreign Source Income).

This is where many clients approach us. They say:

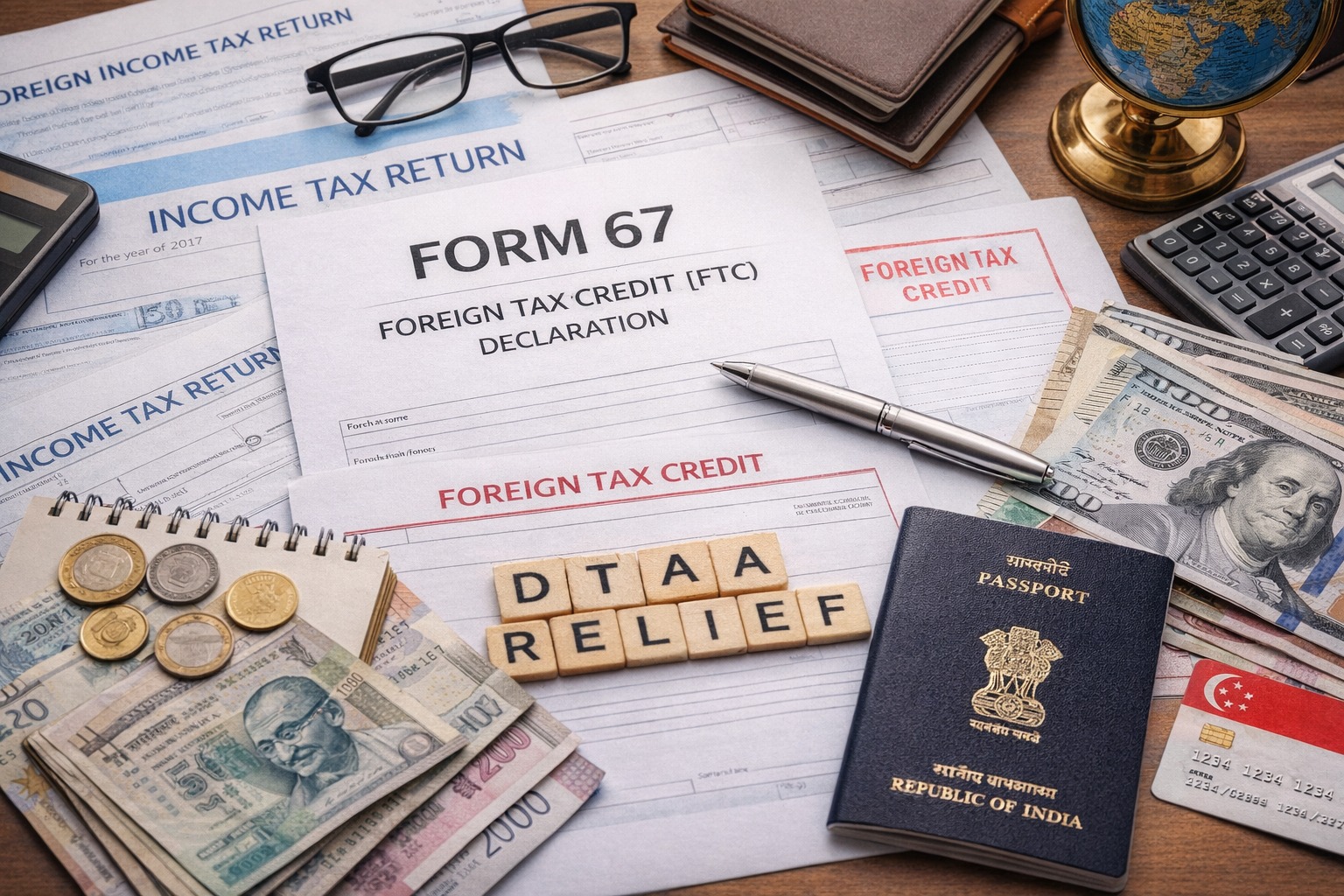

“My consultant only reported my Indian FD income. I didn’t include US salary since it was already taxed in the US. What now?”

Our advice:

You should file an Updated Return (ITR-U) and pay additional Indian tax.

File Form 67 before the updated return to claim credit for US tax already paid, so you avoid double taxation.

Another frequent question our clients ask is: “If I transfer my savings from my US bank to my Indian bank, will it be taxed again?”

The answer: No extra tax.

At DAA, we regularly advise clients in this exact situation. Typically, clients reach out with concerns like:

Here’s how we assist:

This holistic approach ensures our clients remain compliant in both countries without stress.

Q1. Do I need to pay tax in both India and the US?

No. Salary after moving to India is taxable in India only. With Form 8233 and DTAA, you avoid US withholding.

Q2. Can I keep my salary in the US bank?

Yes, but FEMA requires such salary to be repatriated within 180 days. Direct credit to an Indian account is safer.

Q3. Which ITR form should I use?

Usually, ITR-2 is required, especially if you qualify as ROR and must disclose foreign assets.

Q4. What if I missed reporting US salary in India?

You should file an Updated Return (ITR-U) and also Form 67 to claim credit for US taxes paid.

Q5. Is transferring funds from US to India taxable?

No, remittance of your own money is not taxed. It’s only subject to FEMA compliance.

Working for a US employer while living in India is common, but it creates cross-border tax complexities under NRI taxation. Many taxpayers make mistakes like:

At Dinesh Aarjav & Associates, we specialize in India–US cross-border taxation. If you are in this situation, we can help you structure your tax filings, avoid double taxation, and stay fully compliant in both India and the US.

Reach out to us if you are working remotely from India for a US employer—we handle these cases regularly for NRIs, returning Indians, and global professionals.

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.