WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

If you’re an NRI living in the USA and considering withdrawing your Indian EPF (Employees’ Provident Fund), one of the most common questions is:

Is EPF withdrawal taxable in the USA?

The answer isn't black and white – it depends on how EPF is classified under US tax law, and whether you can claim relief under the India-US Tax Treaty.

This blog answers key questions around:

Let’s break it down.

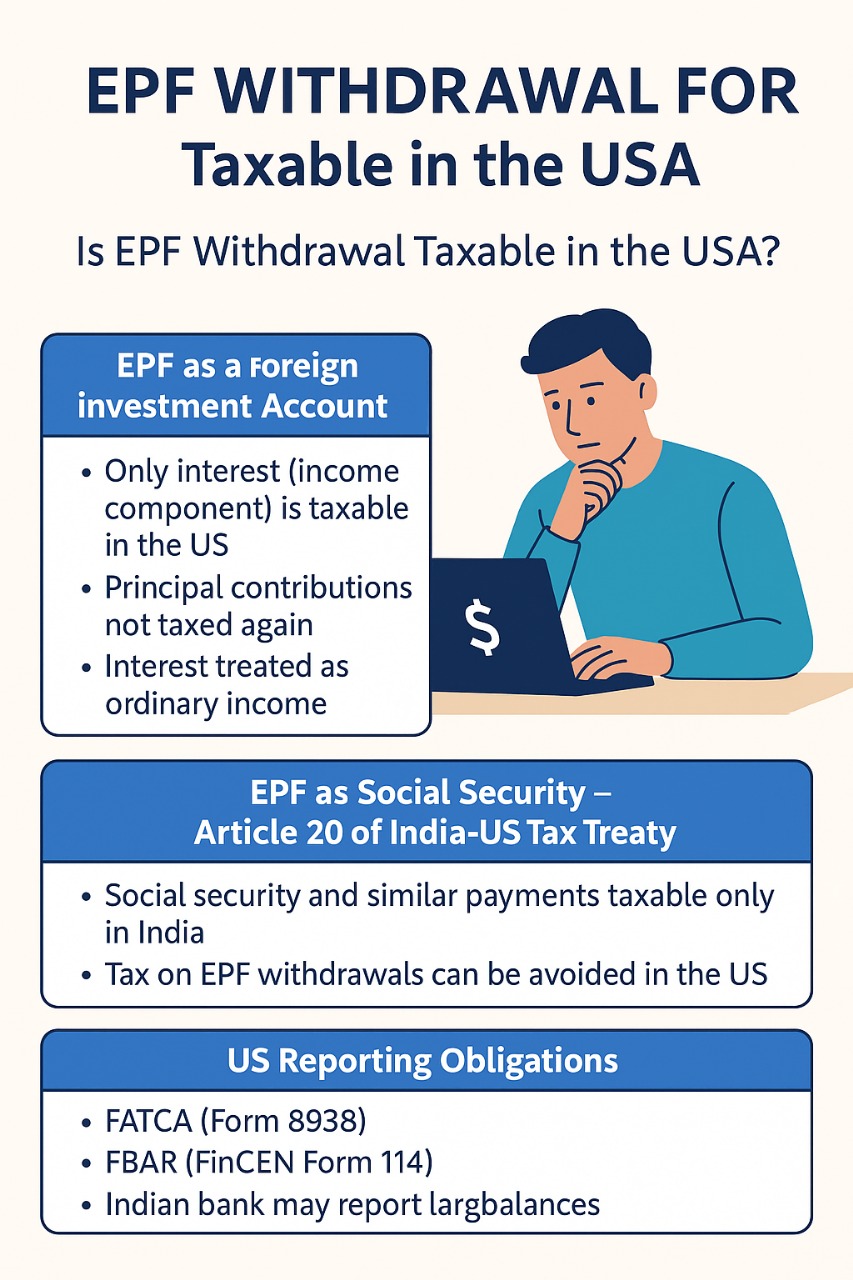

Is EPF Considered Taxable Income in the USA?

There are two widely accepted interpretations of how EPF withdrawal is taxed for US residents or green card holders:

If EPF is treated as a foreign retirement or pension account, the taxation rules typically include:

Tax Tip: To accurately calculate the taxable portion, maintain records of your contributions and annual interest received.

A more beneficial interpretation is to classify EPF as a social security-type scheme under the DTAA India USA. Here’s what that means:

Many NRIs and tax professionals use this position to avoid double taxation on their EPF withdrawals

No, Indian banks do not directly report EPF withdrawals to the IRS.

However:

If your EPF withdrawal is credited to an Indian bank account, and you are a US tax resident, it becomes a reportable foreign asset under FBAR (FinCEN Form 114) and FATCA (Form 8938) rules

FATCA data-sharing between India and the US can flag large account balances

You are responsible for disclosing and reporting such income on your US tax return

| Form | Purpose |

| Form 1040 | Report income portion of EPF withdrawal |

| FBAR (FinCEN 114) | Report Indian bank accounts > $10,000 |

| Form 8938 (FATCA) | Report foreign financial assets |

| Form 3520/3520-A | May be needed if EPF is treated as a foreign trust |

| Form 8621 | Rare; only if EPF holds PFICs like mutual funds |

Penalties for non-filing of FBAR or FATCA can be significant, so always ensure compliance.

Action

We specialize in:

Our team at Dinesh Aarjav & Associates helps NRIs navigate complex cross-border tax matters with clarity and compliance.

Is the full EPF amount taxable in the USA?

No. Typically, only the interest portion is taxable unless EPF is treated as social security under Article 20 of the tax treaty.

Can I avoid US tax using the India-US tax treaty?

Yes. Article 20 allows EPF to be taxed only in India if treated as a social security-like payment.

Do I need to report EPF withdrawal on my US tax return?

Yes, at least the interest earned or total withdrawal should be reviewed and reported as per IRS compliance rules.

Need Help With EPF Withdrawal or Tax Planning as an NRI?

Whether you're a US green card holder, citizen, or NRI in the US, withdrawing your EPF without proper planning can trigger unexpected tax consequences.

Connect with Dinesh Aarjav & Associates – India’s trusted NRI tax advisory firm with over 25 years of experience in cross-border taxation, EPF/PPF withdrawals, and US compliance reporting.