WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

For most NRIs, receiving an income tax notice from India feels overwhelming. Even a single notice on email or post can create panic when you are thousands of miles away. Many NRIs write to us saying they had no clue why the notice was issued or what to do next.

At Dinesh Aarjav & Associates (DAA), we specialize in handling such matters for NRIs globally. With over 25 years of experience and 2600+ clients across the US, UK, Canada, Singapore, UAE, and Australia, we know exactly why notices are issued and how to resolve them effectively.

The Indian Income Tax Department has significantly increased monitoring in recent years. With CRS (Common Reporting Standard) and FATCA agreements, India now receives detailed information about foreign bank accounts, assets, and overseas incomes.

The most common reasons NRIs get notices are:

Each of these errors may seem minor but can easily trigger notices under sections like 142(1), 133(6), 148, or 143(2).

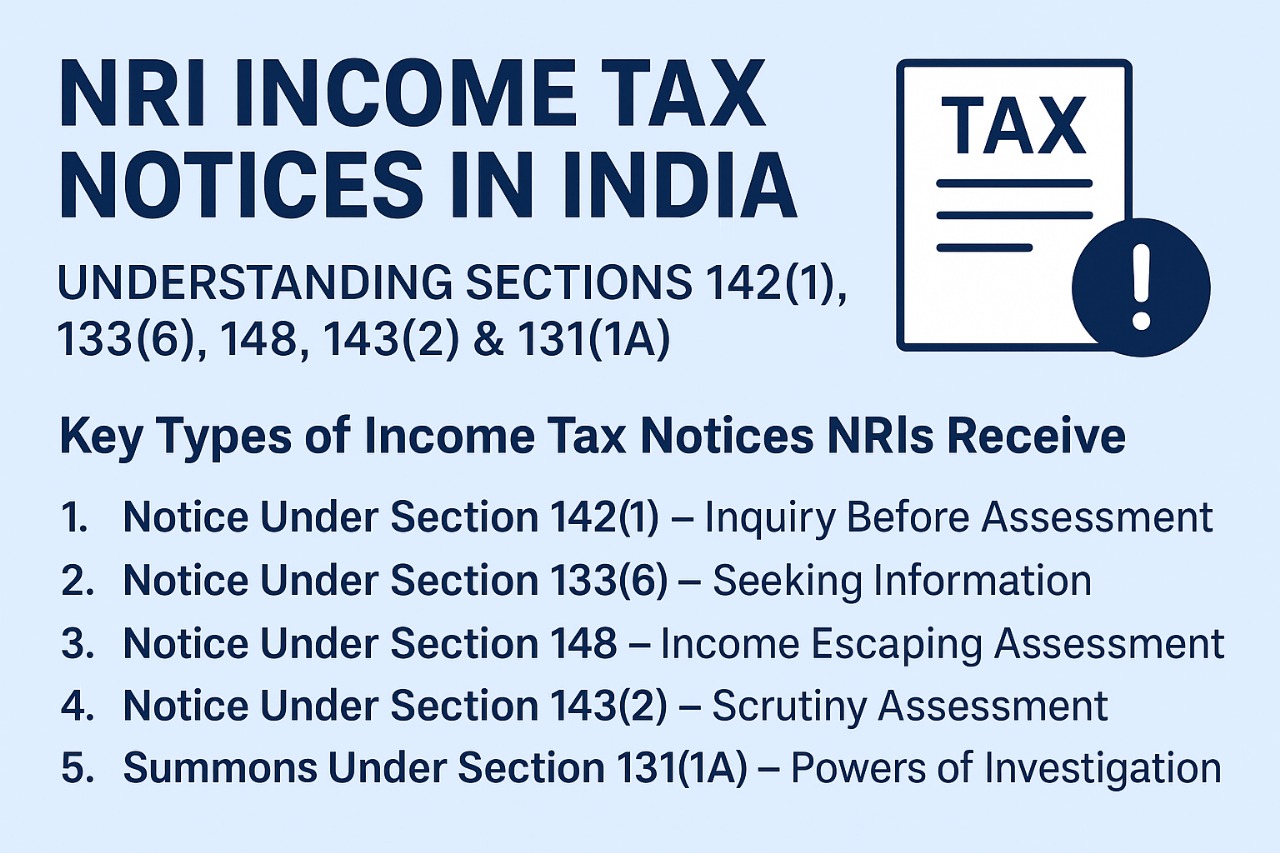

1. Notice Under Section 142(1) – Inquiry Before Assessment

This is usually the first step in the assessment process. It is issued when the Assessing Officer (AO) needs more information to process or complete your return.

Why is it issued?

To call for documents such as computation of income, bank statements, TDS certificates, or proof of foreign income.

NRI Example:

You sold property in Delhi but did not file a return in India. The AO may issue a 142(1) notice asking you to file the return and explain the transaction.

Action Required:

Submit the required documents and explanations within the due date. Failure to do so can result in a best judgment assessment, where tax is computed without your input — often leading to higher demand and penalties.

2. Notice Under Section 133(6) – Seeking Information

This section empowers the AO to call for information from any person, including NRIs, banks, and employers.

Why is it issued?

To verify credits in NRO accounts, overseas employment income, or links to foreign entities.

NRI Example:

You regularly receive foreign remittances into your NRO account. The AO issues a 133(6) notice asking you to explain the source of funds.

Action Required:

Reply promptly with clarity. Provide passport details, overseas employment records, and supporting bank documentation. Many NRIs ignore 133(6) notices thinking they are harmless — but ignoring them often escalates the case to 143(2) scrutiny.

3. Notice Under Section 148 – Income Escaping Assessment

This is a reassessment notice and is considered serious. It is issued when the AO has reason to believe that some income chargeable to tax has escaped assessment.

Why is it issued?

Often triggered by CRS/FATCA information on foreign accounts, undisclosed property transactions, or mismatches between AIS/26AS and ITR.

NRI Example:

You held shares in a foreign company while working abroad, but filed as resident in India without reporting them. Based on information exchange, a 148 notice is issued to reopen your assessment.

Action Required:

File a fresh return in response within the stipulated time (generally 30 days). Non-compliance can result in penalties, prosecution, and reopening of 3–10 previous years depending on the escaped income.

4. Notice Under Section 143(2) – Scrutiny Assessment

A 143(2) notice means your return has been selected for detailed scrutiny.

Why is it issued?

To verify accuracy of income, deductions, exemptions, or foreign asset disclosures.

NRI Example: You claimed DTAA relief on US salary income with the help of DTAA consultancy but failed to attach proper proof. Or you declared NRE interest income as exempt, but the AO wants to verify status.

Action Required:

Attend hearings (physically or through an authorized CA). Submit all proofs and explanations. A well-prepared reply can close the case smoothly.

5. Summons Under Section 131(1A) – Powers of Investigation

This section gives the department investigative powers, almost like a civil court.

Why is it issued?

To probe possible undisclosed income or financial interest in foreign accounts.

NRI Example:

Your name appears in a list of overseas bank account holders reported to India. The Investigation Wing issues a summons under 131(1A) to produce account statements and travel details.

Action Required:

Cooperate fully, submit documents, and reply in a humble and professional tone. Non-compliance can lead to penalties.

Many NRIs think — “It’s just one email, maybe I can ignore it.” But the reality is:

Simply put, one mistake today can snowball into years of litigation and financial stress.

1. Do NRIs need to file Schedule FA (Foreign Assets) in the Indian ITR?

No. As per CBDT instructions and official guidance, Schedule FA is required only if you are a Resident in India. NRIs and RNORs are not required to disclose their foreign assets in the ITR.

2. What happens if I ignore an income tax notice as an NRI?

Ignoring a notice is risky. A 133(6) may escalate into 143(2) scrutiny, a 142(1) may lead to a best judgment assessment, and a 148 notice can reopen multiple past years. Penalties of ₹10,000 per default under Section 272A(1)(c) can also apply.

3. I mistakenly filed as Resident instead of NRI. Will I get a notice?

Yes, this is one of the most common NRI mistakes. Filing as Resident may trigger notices related to foreign bank accounts or overseas assets. This can be corrected by filing a revised return or by replying properly to the notice with residential status proof (passport, employment permit, etc.).

4. Can NRIs keep Savings Bank accounts in India?

No. NRIs should convert existing resident savings accounts into NRO/NRE accounts. Continuing with a savings account as an NRI is a violation of FEMA and often comes under the tax department’s radar during data checks.

5. What is the time limit for a Section 148 (Reassessment) notice?

The Income Tax Department can reopen assessments for up to 3 years in most cases, and up to 10 years if the escaped income exceeds ₹50 lakh.

6. Can I handle a notice on my own or do I need professional help?

Notices like 142(1) and 133(6) may seem simple but mishandling them can escalate the case. For 148 or 143(2), professional help is strongly advised. At Dinesh Aarjav & Associates, we prepare structured replies quoting relevant law and supporting documents to protect NRIs.

7. How can Dinesh Aarjav & Associates help NRIs with notices?

We provide:

Receiving an income tax notice as an NRI is stressful — but with the right guidance, it can be handled smoothly. Many NRIs face notices due to silly mistakes like filing as resident, ignoring 133(6), or keeping savings accounts active.

At Dinesh Aarjav & Associates, we have decades of experience helping NRIs across the globe with NRI taxation services and related matters. Our expertise ensures your case is handled with professionalism and minimum hassle.

Contact us today if you have received a notice under 142(1), 133(6), 148, 143(2), or 131(1A). We’ll help you respond correctly and safeguard your peace of mind.