WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

When venturing into the world of business in the United Kingdom, one of the most crucial decisions you'll face is selecting the appropriate legal structure for your enterprise. This choice can significantly impact your operations, finances, and legal obligations. To help you navigate this decision-making process, we've put together a comprehensive guide outlining the key differences between two popular options: Sole Trader and Limited Company.

Understanding Sole Trader vs. Limited Company:

Sole traders operate as individuals, where the business owner and the business itself are treated as one legal entity. On the other hand, a limited company is a distinct legal entity separate from its shareholders and directors. This fundamental distinction carries various implications, particularly concerning liability, paperwork requirements, and taxation.

Is Sole Trader or Limited Company Better for You?

The suitability of either structure depends on your unique circumstances and business objectives. Each option comes with its own set of advantages and disadvantages:

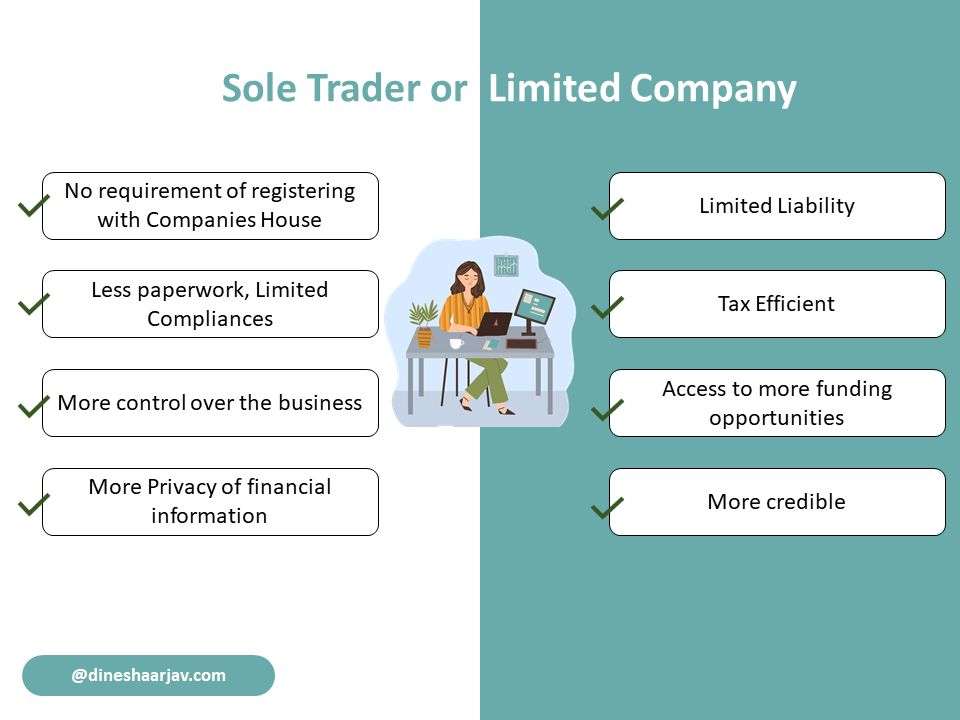

Advantages of Being a Sole Trader:

Disadvantages of Being a Sole Trader:

Advantages of Being a Limited Company:

Disadvantages of Being a Limited Company:

Transitioning from Sole Trader to Limited Company:

While starting as a sole trader is a common choice for many small businesses, transitioning to a limited company is feasible and may become advantageous as your business grows. Reasons for the switch include increasing profits, seeking funding, enhancing business reputation, or attracting new talent.

In conclusion, the decision between sole trader and limited company hinges on various factors such as liability concerns, tax efficiency, funding needs, and business credibility. We recommend consulting with a financial advisor to explore the best option aligned with your business goals and aspirations.

At Dinesh Aarjav & Associates, we understand the significance of this decision and are here to assist you every step of the way. Contact us today to discuss your business needs and embark on your entrepreneurial journey with confidence.

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.