WhatsApp

WhatsApp

Call Us

Call Us

Email Us

Email Us

Whatsapp Community

Whatsapp Community

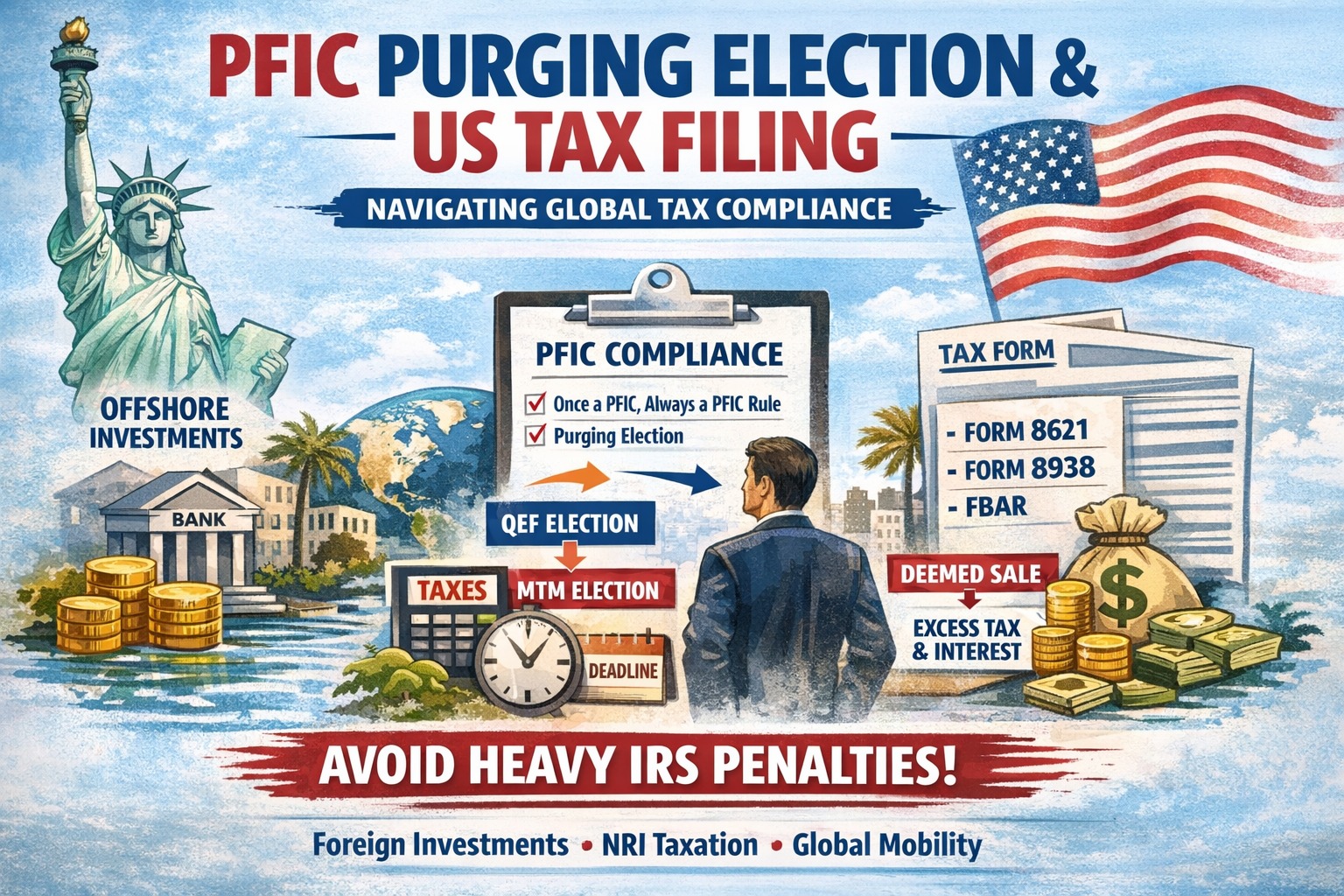

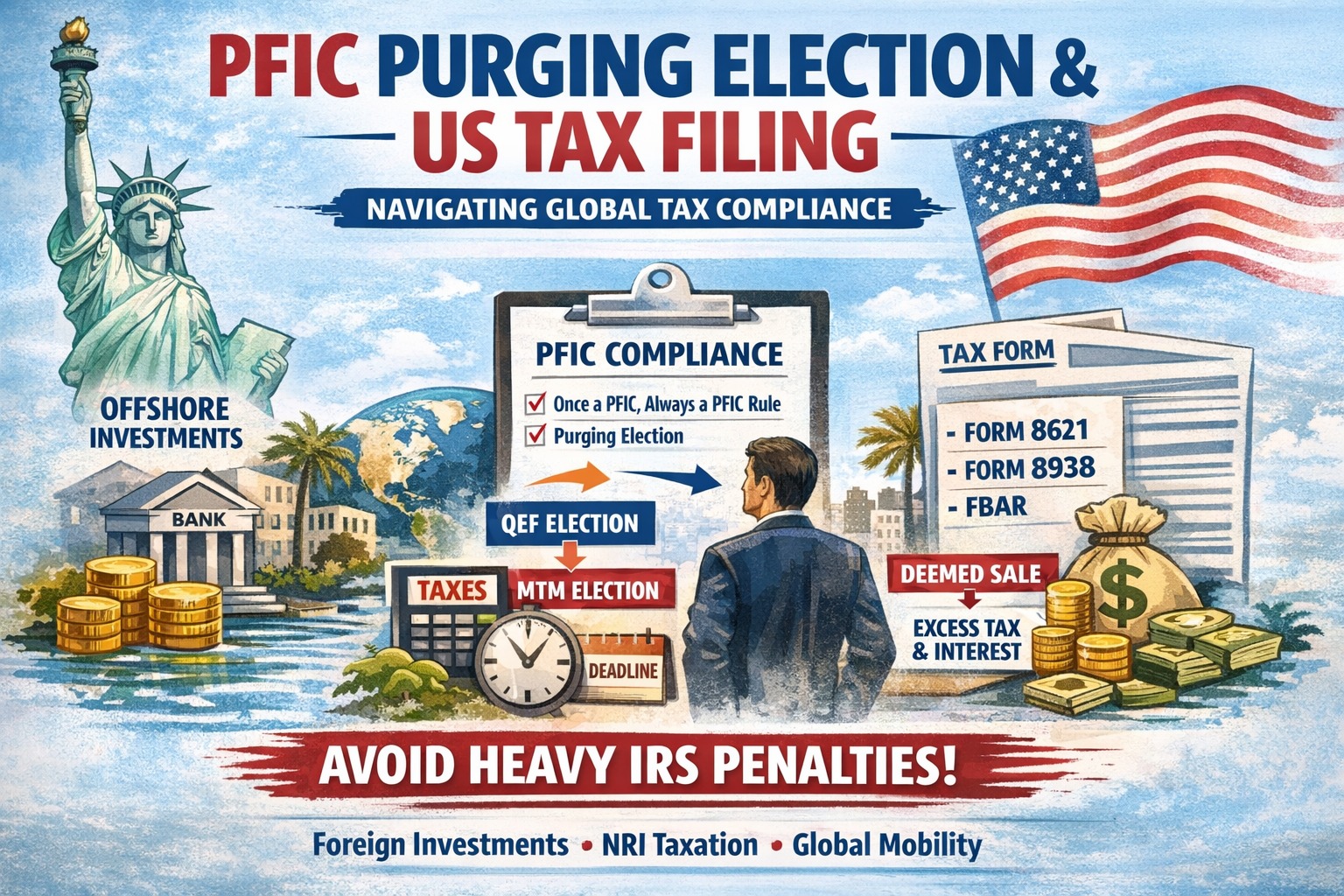

U.S. taxpayers with foreign investments often discover PFIC issues years after investing, usually while filing U.S. tax returns, FBAR, or Form 8938. The PFIC purging election is one of the most critical yet misunderstood U.S. tax strategies available to correct prior PFIC non-compliance.

This comprehensive guide explains:

A Passive Foreign Investment Company (PFIC) is a foreign corporation that meets either of the following conditions in a tax year:

Income Test

75% or more of gross income is passive income (interest, dividends, capital gains)

Asset Test

50% or more of assets generate passive income

PFIC classification applies even if the investor did not know the entity was a PFIC.

Under IRC Section 1298(b), once a foreign corporation is classified as a PFIC during any year of ownership, it continues to be treated as a PFIC for that shareholder forever, unless corrective elections are made.

Consequences:

are subject to the Section 1291 excess distribution regime, even if:

This rule is especially damaging for:

If a U.S. taxpayer does not make a timely election:

the default Section 1291 rules apply.

This significantly increases U.S. tax liability.

A PFIC purging election under Section 1291(d)(2) allows a taxpayer to:

This election is commonly used when:

When a purging election is made:

This allows the taxpayer to move forward with clean PFIC compliance.

A purging election must be:

Incorrect timing = invalid election.

The IRS and Treasury issued final PFIC regulations in December 2020, addressing:

This guidance is crucial for global mobility and cross-border NRI tax planning.

PFIC investments almost always trigger multiple U.S. tax disclosures:

Form 8621

Form 8938 (FATCA)

FBAR (FinCEN Form 114)

Failure to file can result in:

PFIC complications commonly arise when:

Without PFIC planning, US tax filing becomes non-compliant by default.

PFIC purging elections require:

A single error can:

The PFIC regime is one of the most punitive areas of U.S. tax law, but the purging election provides a powerful path to compliance when executed correctly.

If you are:

Expert U.S. tax advisory is critical.

At Dinesh Aarjav & Associates, we specialize in:

Connect with our International Tax Team to ensure accurate, compliant, and audit-ready U.S. tax filings.

Dual Tax Residency for NRIs: US Tax Filing Guide & Compliance 2025

Understanding FBAR Filing: A Crucial Tax Obligation for NRIs in the US

Understanding How Indian Property Capital Gains Are Taxed in the USA

Stay in the loop, subscribe to our newsletter and unlock a world of exclusive updates, insights, and offers delivered straight to your inbox.